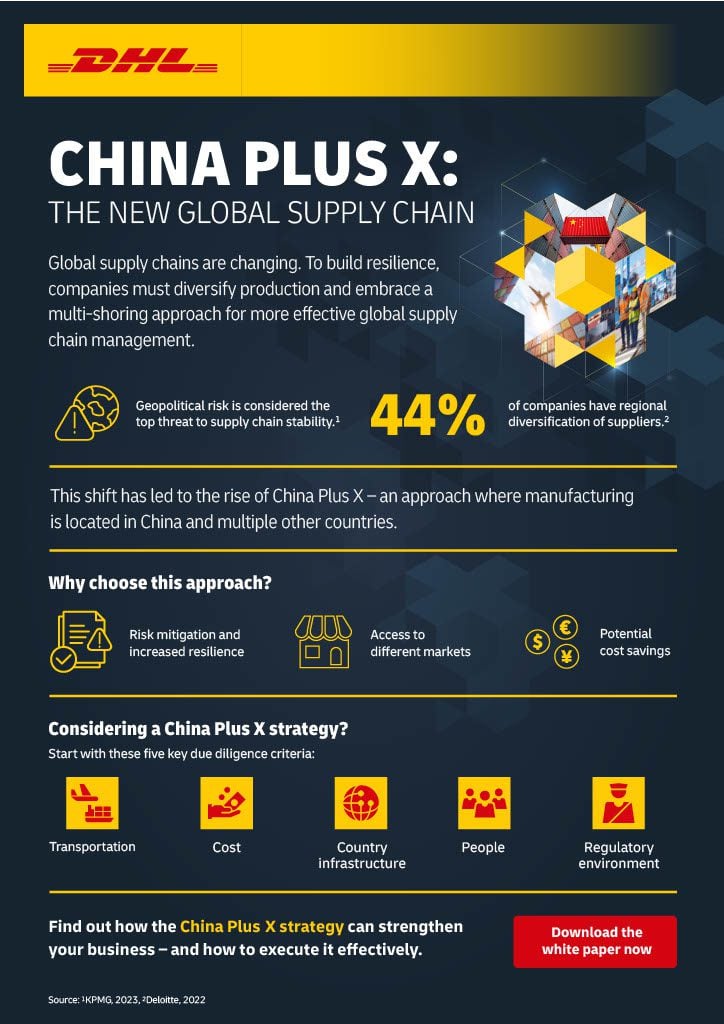

Why a China Plus X strategy is critical for supply chain resilience

Today’s global supply chain landscape is unpredictable. Heightened geopolitical tensions and shifting risk factors such as piracy and extreme weather events can rapidly increase supply chain costs and generate instability.

This is not news to Asia Pacific (APAC) manufacturers. Many have already implemented a ‘China Plus One’ multi-shoring strategy – diversifying production to one other country beyond China to mitigate the risks of unforeseen events. An example of such an event is the Covid-19 pandemic, which precipitated a three-year lockdown in China from January 2020. This cut China’s foreign direct investment (FDI) from $US100 billion in Q1 2022 to US$20 billion a year later.

However, China Plus One is proving insufficient to safeguard organizations from emerging issues such as the tariff changes currently being applied by the new U.S. administration. In response, many are adopting a refreshed ‘China Plus X’ strategy to reinforce supply chain resilience by diversifying to multiple countries outside China.

As discussed in DHL’s new white paper, China Plus X: The New Global Supply Chain, a comprehensive due diligence process to identify appropriate production sites is integral to this strategy. This process should be centered around five determinants: transportation, cost, country infrastructure, people, and the regulatory environment.

Build transport flexibility to combat price fluctuations

As a first step, manufacturers exploring China Plus X to reduce risk exposure should analyze current and future transportation capabilities and costs for potential new sites. With appropriate sites selected, organizations can better safeguard their operations from the volatility of different transport routes, as they will have the flexibility to adapt and deploy capacity elsewhere.

Building in this flexibility is crucial. Movement in trade routes can be highly sensitive to political and economic factors, so unforeseen shifts can prolong delivery times and affect revenue. According to Deloitte research, shipping delays had the largest impact on manufacturers’ supply chains over a 12- to 18-month period.

For example, an uptick in the Houthi attacks at the Red Sea increased delivery times by an average of 10 days for affected freighters, which had to be diverted from their usual Suez Canal route around the Cape of Good Hope.

Freight rates can also vary as consumption demand and capacity supply ebb and flow. Various factors, from port congestions and closures to geopolitical events, have contributed to fluctuating freight rates. According to Statista, the cost of shipping a 40-foot container was as low as US$1,342 in October 2023, only to see it hit an all-time high of nearly US$5,900 in July 2024.

For businesses, a global network provided by logistics firms such as DHL Global Forwarding to alternate between ocean and air freight, or even combining both options, is essential to minimize cost and disruptions. “DHL supports companies with a unique global network and local expertise to successfully shape this transformation. With our extensive portfolio of logistics and transportation solutions, we provide customers with the tools they need to realize their Plus X strategy and to focus on long-term stability”, said Niki Frank, CEO, DHL Global Forwarding Asia Pacific.

Consider potential long-term savings from diversification

Manufacturers pursuing China Plus X should also consider broader costs that can accumulate, such as for raw materials, components, and supplier availability. This explains why 43 percent of respondents in a Deloitte survey identified cost as the primary constraint to adopting a Plus X strategy.

However, it is not a simple equation. While diversifying sites increases simple spreadsheet costs, those who proceed with that strategy can better hedge against expensive events such as trade conflicts.

Within that context, companies with a China Plus X strategy might achieve lower net costs over the long term than those with less diversified production. The latter group will likely be more susceptible to price fluctuations, such as from a new tariff regime, without the ability to deploy resources elsewhere.

Assess the impact of country infrastructure upgrades

A country’s wider digital and physical infrastructure is also a key determinant of its suitability as a location for inclusion in a China Plus X strategy.

For example, DHL’s China Plus X whitepaper notes that the Vietnamese government began implementing a transport infrastructure plan in 2021. By 2030, the country expects to have improved road, air, sea, and inland routes at a total cost of between US$43 billion and US$63 billion. FDI in manufacturing and processing in Vietnam has since increased by 40.2 percent year on year, reaching nearly US$21 billion in November 2023.

These infrastructure upgrades make a China Plus X strategy more viable. They enable manufacturers to reduce risk exposure through site diversification while maintaining or improving access to high-quality, reliable infrastructure.

Leverage skills programs for young workforces

Manufacturers implementing China Plus X to mitigate risk may also enjoy productivity benefits from countries with younger workforces engaging in contemporary skills programs. China’s percentage of citizens over the age of 60 is projected to climb steeply over the coming decades, exceeding 40 percent of the country’s population by 2060.

Hence, the spotlight shines on China Plus X countries. India, for example, is a prime training ground for an upskilled workforce to meet the country’s growing status as a global semiconductor manufacturing hub. Technology companies such as Lam Research Corporation committed to training up to 60,000 Indian engineers in nanotechnology over a 10-year period.

This initiative, together with a $10 billion investment in the India semiconductor mission (ISM) announced by India’s Ministry of Electronics and IT, demonstrates the high potential of India’s workforce.

Look at regulatory environment for financial incentive programs

Lastly, the success of a China Plus X strategy will also hinge on taxes, customs, tariffs, and trade agreements at any new overseas production site. Financial incentives such as tax holidays and reduced corporate rates in one location can counterbalance the disincentives of another, helping to minimize net expenditure for new operations.

For example, Vietnam has signed several key agreements to create new business opportunities, including the EU-Vietnam Free Trade Agreement and Investment Protection Agreement in 2019. These agreements aim to eliminate 99 percent of all tariffs and reduce regulatory barriers and red tape, among other objectives. Under a China Plus X strategy, manufacturers can use such incentive programs while spreading risk over more diverse locations.

China Plus X is a long-term strategy

Enabled by China Plus X, intentional redundancy becomes the new pillar of supply chain resilience. “The future of global supply chains lies in a flexible, sustainable and diversified structure designed for resilience,” noted Frank.

As manufacturers diversify sites across multiple countries, they can partially or fully duplicate processes and facilities, switching between them to mitigate the impact of disruptions. With more options to combat cataclysmic events, these organizations stand a better chance of long-term success.

DHL’s extensive market knowledge and logistics network can provide extensive support for those seeking to adopt China Plus X without costs ballooning. In particular, DHL Global Forwarding’s Multi-Modal Express (MMEX), which blends air and sea transport, can help reduce transit times, emissions, and costs for cargoes traveling from China and Vietnam to the US, Europe, and Latin America.

In time, China Plus X will likely become the new normal as manufacturers observe their competitors reaping the benefits of reduced risk and increased flexibility. However, they should select new sites with care.

ALSO WORTH READING

English

English