Commentary: DHL Global Trade Barometer update (Nov 2019)

The world economy is entering a phase of stagnation, reflecting weak and slowing growth in some major economies and essentially no growth or mild contraction in others.

Fears of a worldwide recession seem premature but the risks have risen as policymakers have little room for maneuver and seem unwilling to undertake significant structural reforms.

Persistent trade tensions, elevated political instability and geopolitical risks, and concerns about the limited efficacy of monetary stimulus continue to erode business and consumer sentiment, with detrimental effects on investment and productivity growth. Growth in household consumption, which has underpinned recent economic performance, has stayed strong but is weakening in major advanced and emerging market economies.

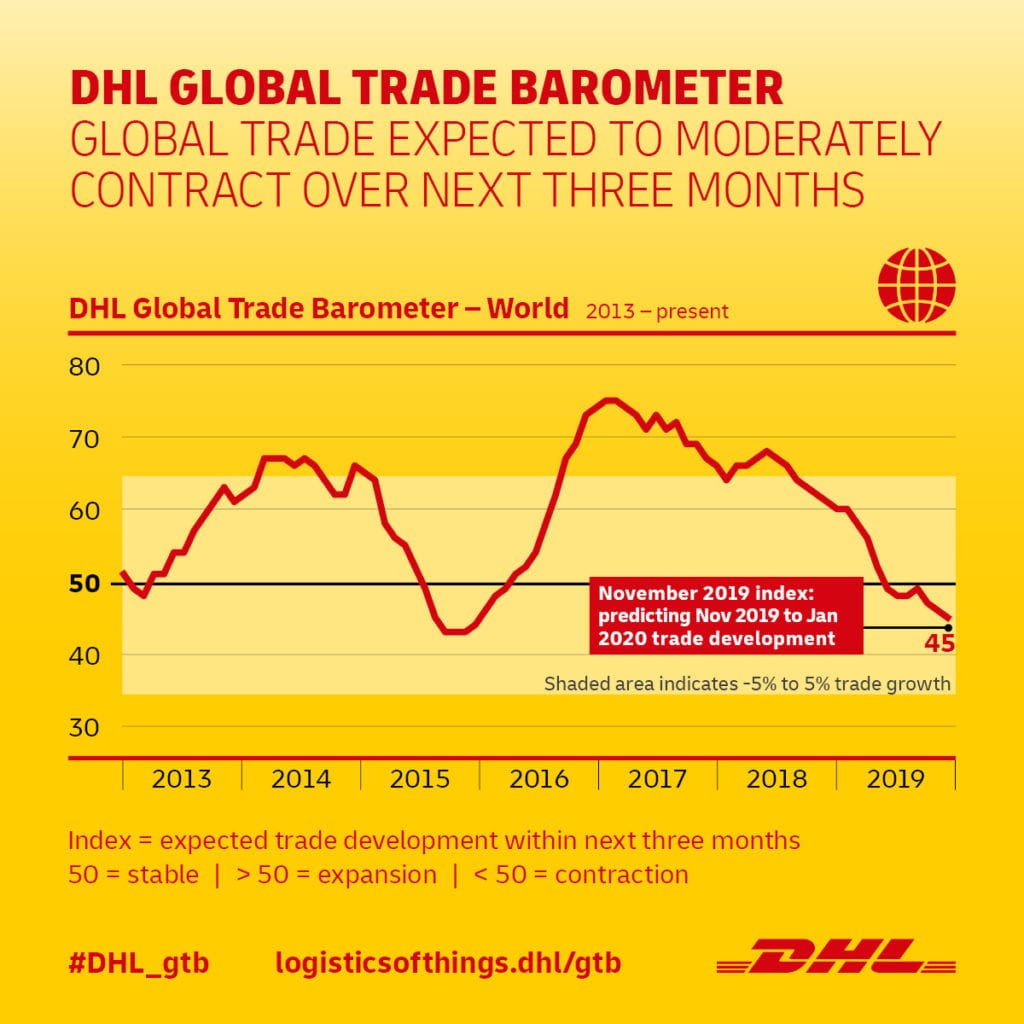

The latest DHL Global Trade Barometer (GTB) update shows that international trade flows have been adversely impacted by these factors. The declining indexes for China and the U.S., the two main drivers of global growth, portend a worsening global economic outlook.

The indexes for other major advanced economies have also declined, reflecting the broad-based nature of the slowdown in trade as well as GDP growth. Trade tensions between the U.S. and its major trading partners, including China, continue to fester and are likely to remain a drag on growth.

Consistent with the GTB data, the Baltic Dry Index, a forward-looking metric based on bulk commodities shipping, has fallen by nearly 50 percent since August (after doubling in the first eight months of the year), erasing hopes for a rebound in global trade.

Along the same lines, the World Trade Organization has cut its forecast for global trade growth in 2019 from 2.6 percent to just 1.2 percent.

Overall, this GTB update paints a sobering picture of gloomy prospects for the world economy and global trade for the remainder of this year.

This commentary was written by Eswar S. Prasad, Professor of Trade Policy and Economics at Cornell University in Ithaca, NY, USA.

MORE FROM THIS COLLECTION

English

English