Brexit uncertainty clouds UK trade outlook

The United Kingdom’s (UK’s) economy has held up relatively well, despite the long-running saga surrounding Britain’s impending exit from the European Union (EU).

The employment rate is at its highest in almost 50 years, and trade has recently expanded after a volatile period. Export volume grew 5.2 percent in the third quarter of 2019, narrowing the trade deficit.

But business sentiment appears to be weakening. A recent Bank of England survey of businesses found that the growth rates of manufacturing output and exports in the third quarter of 2019 were the lowest in three years.

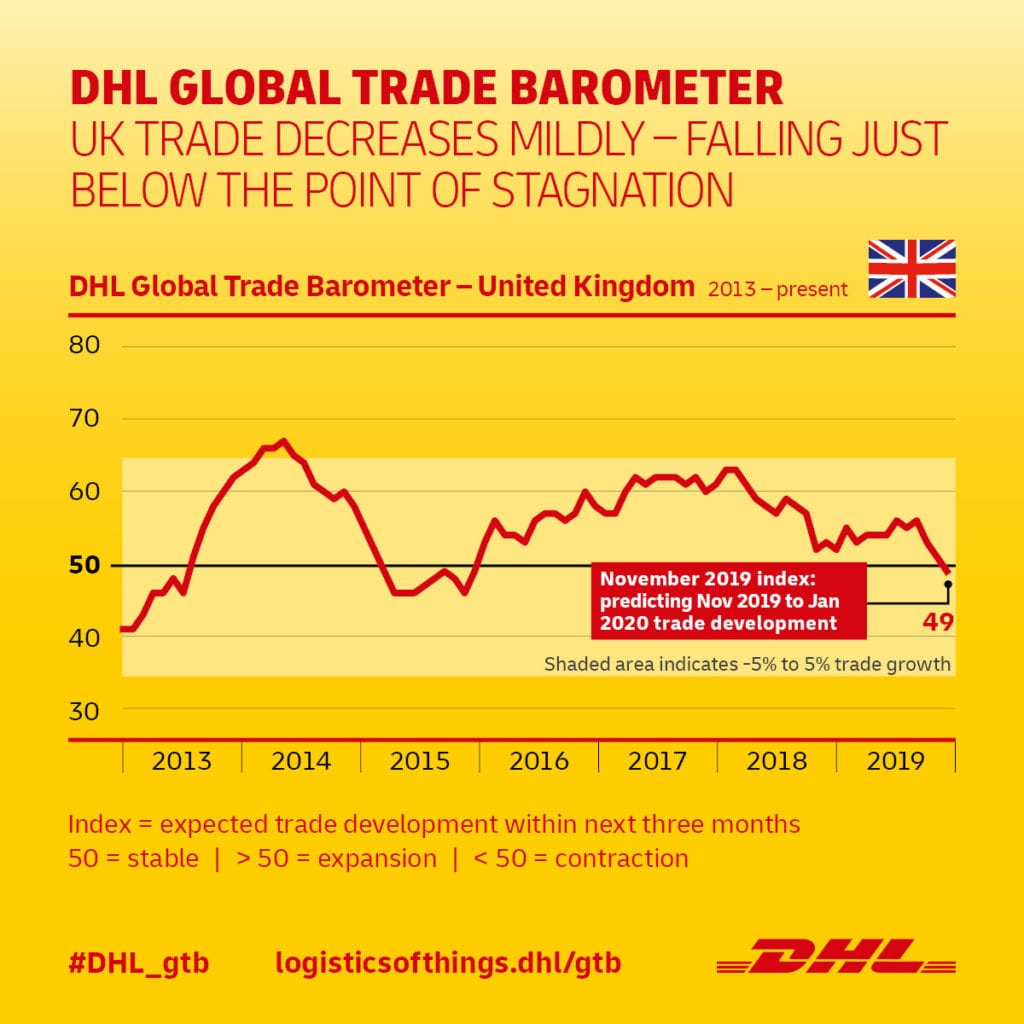

The UK’s trade outlook has also weakened, according to DHL’s Global Trade Barometer, a growth index based on key import and export data. For the first time in four years, the UK’s index fell below 50, hitting 49 in November 2019.

With Brexit delayed yet again — this time to January 31, 2020 — uncertainty is clouding the UK’s economic prospects.

“The outlook depends critically on the nature of the trading relationship between the UK and the EU and other countries,” according to a report from the London-based National Institute of Economic and Social Research (NIESR).

Tough trade negotiations ahead

Politically, the UK has made some progress in agreeing on a Brexit deal, with its parliament approving Prime Minister Boris Johnson’s plan in principle. But analysts do not see an end to the prevailing uncertainty.

The rules that will regulate trade between the UK and EU after Brexit remain uncertain. Negotiations for a free trade agreement (FTA) can only start when the UK formally leaves the bloc.

"The lack of clarity imposed by the Brexit vote in 2016 for trade investment between the UK and the rest of the world has only just begun."

Even if negotiations get off the ground in early 2020, economists doubt the UK and EU can cut a trade deal by the end of 2020, when the Brexit transition is supposed to close. Negotiating and ratifying a trade pact takes time — and the UK–EU deal will likely not be any different.

The EU’s chief Brexit negotiator, Michel Bremier, has given assurances that the EU would work to have a deal ready for the end of 2020. But given the limited time to sew up a deal, negotiations would focus on agreeing on the basics of a trade pact. This suggests that hashing out a broader agreement will likely go beyond 2020.

“Make no mistake about this: the lack of clarity imposed by the Brexit vote in 2016 for trade investment between the UK and the rest of the world has only just begun. We are in for a decade of ongoing uncertainties,” said Erik Nielsen, UniCredit Bank’s London-based Group Chief Economist.

The complex nature of the UK and EU’s uncoupling sets the stage for a difficult process of trade negotiations. The EU has made clear its conditions for agreeing to a trade pact with the UK. For example, it would only work toward a wide-ranging deal if there are “sufficient guarantees for a level playing field,” particularly on state aid, tax, and social, environmental, and regulatory measures.

“Access to our markets will be proportional to the commitments taken to the common rules [of the EU],” said Bremier. “The agreement we are ready to discuss is zero tariffs, zero quotas, zero dumping.”

What if the UK and EU fail to agree on a trade pact?

“For businesses, such a scenario will strongly resemble a no-deal Brexit, with customs formalities and tariffs, but also uncertainty – for example, for British employees in the EU and vice versa,” said Jan-Willem Thoen, Senior Director and Head of the UK/Brexit Desk at PwC Netherlands.

Outlook under an FTA

According to Sam Lowe, a senior research fellow at the Center for European Reform, British businesses would have to reckon with higher costs and trade friction if the UK inks an agreement with the EU.

“A December 2020 shift to an FTA with the EU would require many British businesses to adjust as much as if the UK were to exit without any future relationship in place,” he said.

UK exporters would have to prove that their goods meet the FTA’s rules of origin requirements even with a zero-tariff trade agreement — which would involve extra paperwork, costs, and complications, according to Lowe. Businesses trading between the UK and EU would have to make customs and security declarations, deal with inspections, and pay tariffs for goods outside the FTA.

In the services sector, cross-border trade liberalization would be limited, said Lowe.

Trade opportunities

Even a Brexit deal that transitions smoothly to a trade pact would ultimately lead the UK economy to be about 3.5 percent smaller each year than it would have been had the UK remained in the EU, according to the NIESR.

This will put the onus on many UK businesses to consider opportunities elsewhere. According to global law firm Baker McKenzie, businesses should pursue open growth strategies and explore alternative markets that offer the most potential to compensate for losses from leaving the EU.

“Organizations should start to focus on the different trade deals that may be on offer with third countries, to give the UK government a steer on what its priorities should be,” said Samantha Mobley, head of Baker McKenzie’s EU, Competition and Trade Practice Group in London.

To this end, Baker McKenzie identifies the best trade opportunities in ‘third markets,’ based on the current size of global exports to those countries and future projections. Not surprisingly, the U.S. offers the most potential, followed by China. But the firm has also found sectorial opportunities in Australia, Canada, Japan, Mexico, South Korea, and Switzerland.

MORE FROM THIS COLLECTION

English

English