Trade war accelerates shift of production from China

“We will be taxing the hell out of China,” exclaimed United States President Donald Trump at an evening rally in early August.

Hours earlier, on the same day, Trump had just announced a 10 percent tariff on a further US$300 billion (€269 billion) in Chinese imports.

This is just one of many developments escalating the long-drawn U.S.-China trade war which has already seen many repercussions, none more so than the growing trend of large companies shifting manufacturing out of China.

Previously, their primary motivation was to lower production costs or to take advantage of tax breaks in neighboring countries. Now, it is to take cover from punitive U.S. tariffs.

In July, more than 50 multinational companies were looking to relocate its manufacturing operations to Southeast Asia from China in a bid to avoid U.S. tariffs, while also lowering production costs and maintaining proximity to key markets.

First to go

Low-skilled sectors such as textiles and garments were among the first to leave China, even before its trade tensions with the U.S. But moving the production of knowledge-intensive sectors such as high technology is proving to be more difficult.

The DHL Global Trade Barometer (GTB), for example, shows that trade growth in China’s consumer fashion goods sector is slowing. The sector’s index plunged from 37 points in June 2019 to just 29 in September.

Likewise, the high technology trade experienced a gradual decline in the same period, despite a steady outlook in the previous quarter, as high-technology companies seek to avoid U.S. tariffs.

For instance, American PC makers HP and Dell are considering transferring 30 percent of their notebook production from China to Southeast Asia and elsewhere. Global electronics giant Samsung also recently pulled the plug on its last mobile phone factory in China, citing rising labor costs and the economic slowdown.

Companies across a diverse range of sectors, from personal goods and electronics to technology and machinery, have moved, or are also looking to move production out of the country.

Where does this leave China?

An exodus of manufacturers to Southeast Asia will have a significant impact on China, according to Abdul Abiad, Director of Macroeconomic Research Division at Asian Development Bank (ADB).

“The analysis we have done indicates that the trade conflict as it stood at end-May 2019 would shave a cumulative 0.5 percent off China’s GDP relative to a no-conflict scenario, with the impact playing out over two to three years,” said Abdul.

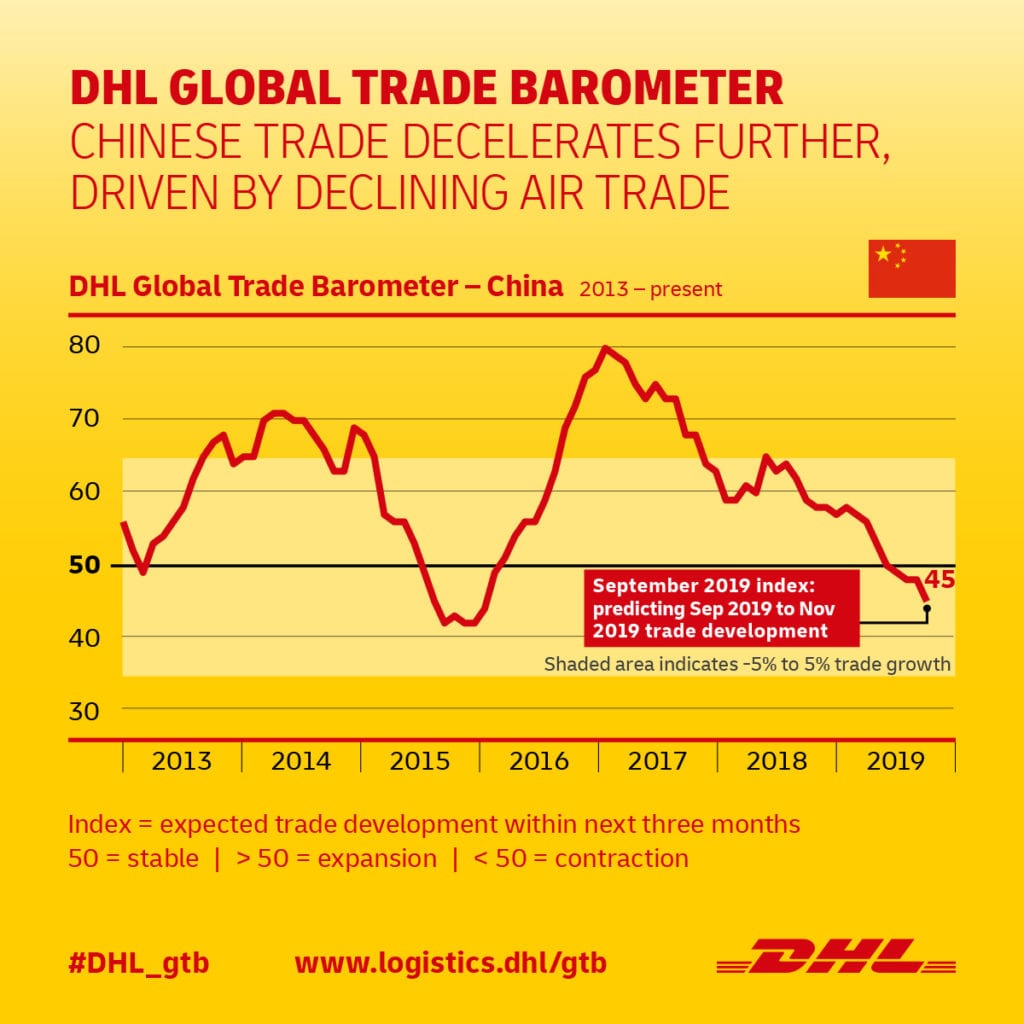

DHL’s GTB shows that Chinese trade contracted from 49 points in June 2019 to 45 in September.

Key sectors reveal deteriorating trends in recent months. Trade in chemicals and chemical products, for example, fell by nearly nine points over three months to 57 in September. Trade in land vehicles and parts also dropped over 17 percent to 29 points over the quarter.

A full escalation of the trade dispute could be doubly damaging. In ADB’s estimate, it would trim China’s GDP by 1 percent and total exports by an additional 4.2 percent.

“The longer the trade conflict persists, the worse the impact on China, and the greater the likelihood that trade and production will relocate,” said Abdul.

The biggest winner

The shift of production from China will benefit Southeast Asia the most. Countries in the region generally have the right conditions to attract production, according to Abdul.

“They already produce goods similar to what China produces. They have stable macroeconomic environments, and labor is less costly than in China,” said Abdul.

In an analysis by Japanese financial group Nomura, Vietnam would be the biggest winner of a shift in production and foreign direct investment from China, followed by Malaysia, Singapore, India, and Thailand.

China’s foreign direct investment in Vietnam, based on approved projects, surged by more than five times to US$1.56 billion between January 2019 and May 2019. A full escalation of the U.S.–China trade war could boost Vietnam’s exports by more than 7 percent.

Besides its lower costs, Vietnam’s geographic location makes it a suitable manufacturing hub, according to Shoeib Reza Choudhury, Country Manager and General Director of DHL Express Vietnam.

“Vietnam is highly connected to China on the northern side, which makes the supply of raw materials quite easy for manufacturing, and through the South China Sea and Pacific, it is also connected to North America,” said Choudhury.

But Vietnam is now at risk of attracting tariffs as Trump ramps up pressure on the Southeast Asian nation to reduce its trade surplus with the U.S.

Textile, computer, and seafood exports are particularly vulnerable, according to Sian Fenner, an economist at Oxford Economics. In July, the U.S. hit Vietnamese steel imports with tariffs of more than 400 percent.

While Malaysia has not made headlines as much as Vietnam, it is another big winner of the protracted trade war.

China’s investment in Malaysia’s manufacturing sector has more than quadrupled over the past five years. Foreign direct investment from China for planned manufacturing projects rose about 410 percent on the year to RM19.7 billion (€4.2 billion) in 2018 alone.

Amid the intensifying trade tension between the U.S. and China, Malaysia has been projecting itself as a stable and safe manufacturing hub.

“While a prolonged U.S.–China trade war would not be welcomed by a small and open economy like Malaysia, there are mitigating factors that will somewhat cushion the impact for us,” said Ong Kian Ming, Malaysia’s Deputy Minister for International Trade and Industry.

Until the trade war reaches a conclusion, the pivot by manufacturers toward Southeast Asia looks set to continue.

MORE FROM THIS COLLECTION

English

English