ASEAN–China trade surges, but for how long?

The Association of Southeast Asian Nations (ASEAN) has traditionally adopted a cautious approach when navigating its relationship with China, sometimes through rough waters.

Over the past few years, for instance, competing claims of territorial sovereignty in the South China Sea have often caused tension and wariness between China and the bloc.

But China’s trade war with the U.S. is changing the dynamics of its relations with ASEAN.

As China’s trade challenges grow, it has been trying to further integrate its economy with its neighbors. Meanwhile, some ASEAN member countries, worried by U.S. President Donald Trump’s America First policy, have also been forging closer trade relations with China. That includes Vietnam and the Philippines, both of which have had disputes with the Asian giant over South China Sea territories.

ASEAN’s neutrality toward major economies has made it attractive to China. As a result, the bloc has dislodged the U.S. to become China’s second-largest trading partner. Its trade with China reached RMB1.98 trillion (€250.72 billion) in the first half of 2019, larger than the RMB1.75 trillion between China and the U.S.

China’s pact with the group — the 15-year-old ASEAN–China Free Trade Area — has given it a buffer against the fallout from its quarrel with the U.S. This, in turn, has provided ASEAN economies with a windfall.

But how long will the increased trade last? And which countries stand to benefit most?

Robust trade to continue

Research group ASEAN+3 Macroeconomic Research Office (AMRO) suggests trade between China and ASEAN will continue to grow for some time, largely thanks to a number of initiatives.

China’s Belt and Road Initiative (BRI), for example, is speeding up its economic integration with ASEAN. The Chinese government is directing BRI infrastructure investments toward ASEAN. It believes the strategy’s success significantly lies in building greater trade connectivity with the region.

One of the early recipients of investments through the BRI is Malaysia. In 2016, Malaysia Rail Link signed a contract with China Communications Construction Company to build a RM44 billion (€9.5 billion) railway, the program’s centerpiece project.

Cambodia, the poorest member country in ASEAN, has also gained from BRI investments. Financial services company Moody’s recently identified the country as one of the four economies to potentially benefit most from the program.

For example, the BRI-linked project Sihanoukville Special Economic Zone now employs more than 20,000 Cambodians. It is expected to provide up to 100,000 jobs when the second phase of the development wraps up.

Shifting trade flows

ASEAN stands to gain more from its trade relations with China as manufacturers move production from China to countries such as Vietnam and Thailand to avoid American tariffs. AMRO forecasts the bloc’s exports to China will grow to US$911 billion (€824.62 billion), or 11.6 percent of its gross domestic product (GDP), by 2035.

Of the ASEAN economies, Vietnam stands to win considerably from China’s trade conflict with the U.S., according to the Asian Development Bank (ADB).

“We estimate that under a full bilateral escalation scenario, Vietnam’s economy could be boosted by up to 2 percent over the long run,” said Abdul Abiad, Director of ADB’s Macroeconomic Research Division.

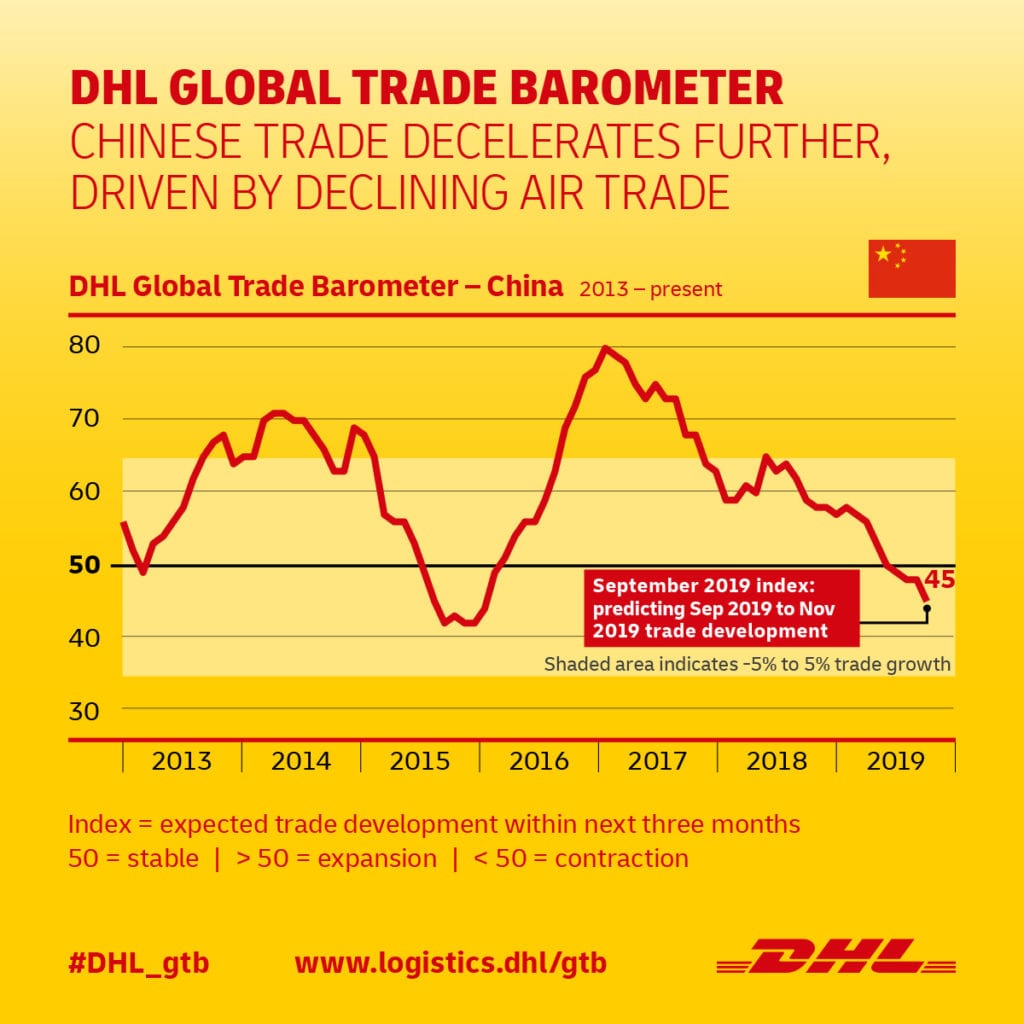

As it is, DHL’s Global Trade Barometer indicates a slowing growth outlook for China — Chinese trade contracted from 49 points in June 2019 to 45 points in September.

A full escalation of the country’s trade war with the U.S. is expected to seriously hurt its economy. In ADB’s estimate, it would trim China’s GDP by 1 percent and total exports by an additional 4.2 percent.

“The longer the trade conflict persists, the worse the impact on China and the greater the likelihood that trade and production will relocate,” said Abdul.

ASEAN: strongly placed

Despite the trade war’s damage, observers believe China will continue to grow and become the largest market for raw materials and manufactured goods.

“China’s growing importance as an importer is a gradual sea change which is still not yet widely noticed,” said George Yeo, a former Singapore minister of trade and industry.

And ASEAN is well positioned to gain from China’s continued rise. Several member countries, including Malaysia, Indonesia, Vietnam and Thailand, have established robust bilateral trade relations with China, their largest trading partner.

AMRO expects ASEAN’s exports of labor-intensive products and raw materials to China to grow considerably.

“In 2017, ASEAN’s exports of labor-intensive goods were much lower than most other types of exports to China,” said AMRO in a report. “By 2035, ASEAN is expected to export considerably more of these products to China.”

MORE FROM THIS COLLECTION

English

English