U.S.–Japan limited deal: What it means for trade

A year after Japan cautiously agreed to bilateral talks with the U.S., President Donald Trump and Prime Minister Shinzō Abe announced in September 2019 that they had reached a limited trade pact.

Trump’s administration worked hard to sew up a quick deal with Japan in response to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) — a free trade agreement signed by 12 countries, not including the U.S.

The CPTPP was seen to be disadvantaging some U.S. exports. For example, CPTPP economies now enjoy lower tariffs on beef exports to the lucrative Japanese market, giving them an edge over American beef. The U.S.’ withdrawal from the original Trans-Pacific Partnership meant its meat exports received no preferential tariff treatment in Japan.

To bring Japan to the negotiating table, Trump threatened to raise tariffs on Japanese vehicles and auto parts from the current 2.5 percent to 25 percent. If implemented, the tariffs would have a damaging effect on the vehicles and auto parts industry which accounts for about 33 percent of Japan’s total exports to the U.S. — worth ¥448.6 billion (€3.8 billion) in July 2019 alone.

Not only does the Japanese government have an interest in shielding these exports from any punitive tariffs, but it is also counting on U.S. support as its diplomatic spat with South Korea intensifies.

But have both countries got what they wanted from the deal?

Pared back tariffs on American beef

The newly signed pact, which experts say mirrors the Trans-Pacific Partnership (TPP), covers more than 90 percent of American food and agriculture exports to Japan, according to the U.S. Trade Representative.

As part of the deal, these goods will either be duty-free or enjoy lower tariffs.

What's the deal?

What's the deal?

Under the agreement, Japan will:

- reduce tariffs on American fresh and frozen beef and pork

- provide a quota for wheat and wheat products

- reduce the mark-up on imported U.S. wheat and barley

- immediately remove tariffs on agriculture products such as almonds, walnuts, blueberries, cranberries, sweet corn, grain sorghum, and broccoli

- progressively eliminate tariffs on products such as cheese, processed pork, poultry, beef offal, ethanol, wine, frozen potatoes, and oranges

The pact gives American farmers and ranchers the same advantage as CPTPP economies in Japan.

The U.S. government expects the deal to open the Japanese market to more than US$7 billion (€6.4 billion) of additional American agriculture products a year. This would bring Japan’s imports of such goods to more than US$21 billion.

No auto tariff pledge

In Japan, what the government prioritized from the deal was an assurance that the U.S. would not slap 25 percent tariffs on Japanese vehicles and auto parts.

However, the official information about the accord makes no specific mention of auto tariffs. Apart from agriculture, the pact only covers digital trade, barring both countries from imposing duties on electronically conveyed products such as videos.

According to former Japan trade ministry official Masahiko Hosokawa, the pact favors U.S. interests. “Lowering agricultural product tariffs to CPTPP levels and [eliminating] auto tariffs should have been agreed as a package. Japan completely gave up on that,” he said.

....Tariffs will make our country much richer than it is today. Only fools would disagree. We are using them to negotiate fair trade deals and, if countries are still unwilling to negotiate, they will pay us vast sums of money in the form of Tariffs. We win either way......

— Donald J. Trump (@realDonaldTrump) August 4, 2018

Although Trump said in August that he was not looking to impose higher auto tariffs on Japan, he had earlier supported the U.S. Secretary of Commerce’s finding that high quantities of imported vehicles pose a threat to national security.

Trump invoked Section 232 of the U.S. Trade Expansion Act, which allows the president to levy tariffs on national security grounds, to slap tariffs on aluminum and steel, raising fears in Japan that he could do the same with vehicles.

Tariffs as high as 25 percent would hurt Japan’s trade performance, which has already taken a hit from slowing global growth. Exports fell for a ninth straight month in August 2019, according to the Ministry of Finance.

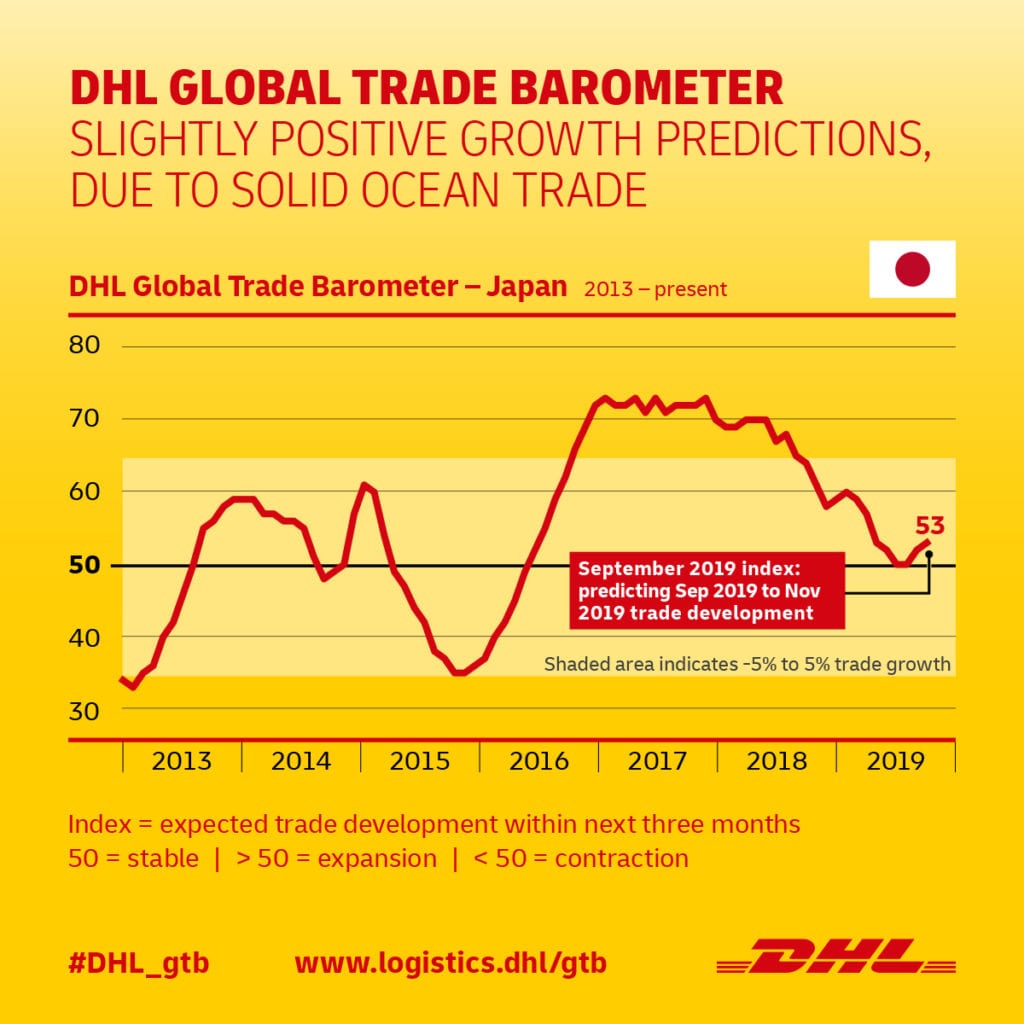

But Japan’s prospects are not all doom and gloom. DHL’s Global Trade Barometer (GTB) forecasts mild growth for Japanese trade in September 2019, with the index moving upward by 3 points to 53.

A comprehensive deal

Some observers expect the U.S. to use Japan’s auto exports to negotiate a broader trade deal in the future. Trump said during the signing of the accord that the U.S. and Japan will continue negotiations to work on a more comprehensive pact.

“We’re negotiating very, very big transactions with Japan. Some of them — I think probably all of them in the not-too-distant future will happen,” he remarked. “But in the fairly near future, we’re going to be having a lot more very comprehensive deals signed with Japan.”

The fact that auto tariffs were left out of the limited deal does not mean the risk of such tariffs is high, according to Scott Seaman, Asia Director of risk advisory firm Eurasia Group. But “it leaves a dark cloud over both countries.”

MORE FROM THIS COLLECTION

English

English