Why India’s e-commerce needs to be sustainable to maintain explosive growth

E-commerce has turned into one of India’s biggest trade stories. After reaching USD 46.2 billion (EUR 46.3 billion) in 2020, the market is forecast to hit almost USD 75 billion this year – and USD 350 billion by 2030.

Some of the most popular product segments behind this growth are beauty and personal care, footwear, fashion accessories, health and pharmaceuticals, as well as fast-moving consumer goods.

But this success is coming at an environmental cost that demands a response if growth is to continue. While the challenge is significant, there are positive signs that sustainability has become a key focus for many stakeholders.

Understanding the growth behind e-commerce

The Covid-19 pandemic may have accelerated this expansion, but e-commerce was already growing dramatically before that, thanks to the rapid increase in internet and smartphone access across urban and rural India. By 2019, there were an estimated 627 million internet users, a figure that has grown to 692 million today. And with more than 760 million people yet to go online, the potential is massive.

“The digital transformation of India that’s currently underway is expected to accelerate the growth of e-commerce, changing the retail consumer market landscape over the next decade,” said Rajiv Biswas, IHS Markit’s Asia Pacific Chief Economist. “This is attracting leading global multinationals in technology and e-commerce to the Indian market.”

Amazon, Walmart, Facebook, and Singapore-based Shopee have all invested in the local e-commerce market. Walmart bought a majority stake in the Indian e-commerce giant Flipkart while Facebook invested in the technology firm Jio Platforms, which owns the online marketplace JioMart.

These and more recent activities and entrants are driving competition, sales, and importantly, innovation to provide better experiences and more options to customers. They have also given rise to a thriving ecosystem of services – some of the most significant being digital payments, shipping, and logistics. In fact, India’s e-logistics sector is now one of the world’s fastest growing markets and is forecast to reach US$9 billion by FY2026.

Challenges catch up with growth

But the colossal growth in e-commerce has come with a string of challenges, driven by changing buying and consumption practices of Indian customers. Two of the most pressing issues right now are the ability, or capacity, to meet ever-increasing demand and, more importantly, the question of how e-commerce can achieve sustainability amid its explosive expansion. Both can have significant implications for growth.

With the continuing massive shift to online shopping, retailers need to procure, store, pack, and ship more products. But the bigger challenge for merchants and their service providers is how to get these products to customers in the shortest time – and in the most sustainable way -- possible.

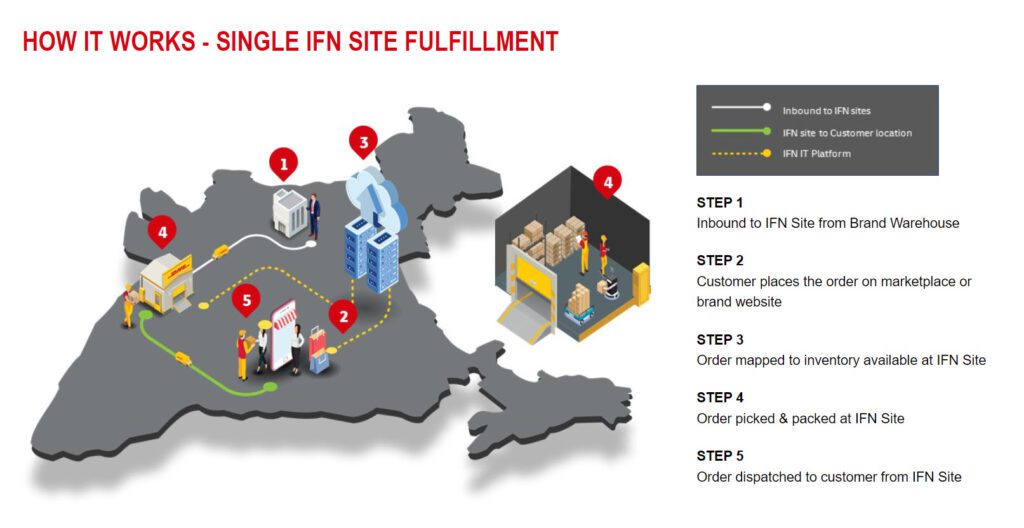

Logistics firms such as DHL Supply Chain India have a clear understanding of these challenges, leading to the creation of its DHL Fulfilment Network (DFN). First launched in Bengaluru, followed by Mumbai, Delhi, and Ahmedabad, the DFN, integrated with marketplaces, brand websites, and inventory stocking points, creates a seamless network, allowing consumers from the top 80 cities in India to receive their e-commerce purchases within the next business day.

On top of its DFN, DHL Supply Chain is also increasing its warehouse footprint by 12 million square feet of capacity in key metro cities such as Bangalore and Chennai. “The expansion’s main goal is to bring products closer to end customers, and helping reduce carbon emissions to maintain a sustainable supply chain,” said Terry Ryan, CEO, DHL Supply Chain Asia Pacific.

Changing expectations

The convenience of online shopping – and the promise of rapid delivery by e-commerce giants like Amazon – have drastically changed customer expectations and the retail game. Same-day or next-day delivery is increasingly becoming the norm.

“The standard has been reset by the likes of Amazon and several other market leaders, which are placing increasingly strong pressure on incumbent players to respond,” said a McKinsey report.

The growing customer demand has since prompted DHL Supply Chain India to meet these challenges with the opening of more Business Support Centers (BSC) to provide round-the-clock support services to its customers in India and globally. Two new BSC in Bangalore and Pune will be set up within the next 12-18 months, on top of its existing ones in Mumbai, Gurgaon and Chennai, providing services such as Business Analytics to support decision-making.

This support works in tandem with larger retailers in India that are keeping up by innovating, investing in warehousing and distribution, and digitizing their supply chains. Many of them have relied on last-mile deliveries to meet the surge in demand for online groceries, working with small logistics and trucking companies to get products to their final destination.

Environmental challenges abound

While many merchants are finding ways to meet customer demands, achieving sustainability is a fundamental challenge that needs to be addressed. From warehousing and packaging to shipping and last-mile delivery, there are serious environmental and other sustainability issues e-commerce businesses must consider and address.

Recent research shows that India’s last-mile emissions per delivery of 285 grams carbon dioxide (gCO2) are much higher than the global weighted average of 204 gCO2. In fact, the research found that five Indian cities – Delhi, Mumbai, Kolkata, Bangalore, and Chennai – release more carbon dioxide from last-mile delivery than the entire last-mile emissions of France or Canada.

“The short trips that millions of delivery vehicles take every day have a disproportionate impact on pollution, smog, air quality, and, ultimately, our health, as well as our ability to achieve a zero-emission future,” said Siddharth Sreenivas, India Coordinator of Clean Mobility Collective, one of the organizations behind the research.

Greater congestion in Indian cities could also be contributing to the country’s larger emissions – not to mention higher transportation costs and inefficiency in logistics. This highlights the need for more sustainable transportation in last-mile delivery by transitioning to electric vehicles.

Shifts in customer awareness is both a driver of change, and of demand for more sustainable practices. Indian customers’ growing recognition of the need for sustainability in products is helping to support moves to more sustainable e-commerce supply chains. A recent survey by Bain & Company shows 52 percent of customers in urban India expect to increase their spending on sustainable products over the next three years, with more than 60 percent saying they are willing to pay a premium for such products.

Businesses are starting to act

An increasing number of companies are paying attention – and taking action.

As a partner to such Indian businesses, DHL Supply Chain India supports their e-commerce expansion in a sustainable manner. As part of the alignment with Deutsche Post DHL Group’s roadmap to have climate-neutral logistics by 2030, DHL Supply Chain India will convert its whole intra-city fleet to green fuel or electric vehicles by 2025. “As a start, we will be converting 100 percent of our entire two-wheeler fleet to electric vehicles by the end of this year,” said Vikas Anand, Managing Director, DHL Suppy Chain India.

Flipkart, for example, plans to transition its entire last-mile fleet to electric vehicles by 2030 as it aims to achieve net-zero emissions by 2040. It has also been trying to use less and sustainable packaging. In 2021, the company announced that it had eliminated single-use plastic packaging from its supply chain.

Dunzo, a last-mile delivery firm for groceries and other essential items, is relying more on micro-fulfillment centers. These small and often automated storage facilities are found in places close to end-customers. Their increased use can cut carbon emissions by reducing the need for long-haul transportation while also reducing costs.

According to Dunzo CEO Kabeer Biswas, taking advantage of micro-fulfilment centers will enable the company to deliver the top 2,000 products customers want on a daily or weekly basis in just 19 minutes. “This is currently the fastest and the most efficient way to get daily and weekly groceries delivered in Bengaluru.”

It is clear that for India’s e-commerce industry to fulfil its true potential, speed and sustainability have to go hand-in-hand. “The endgame is to create a robust delivery ecosystem for e-commerce that is sustainable, both economically and environmentally, to meet India’s growing customer demand,” noted Ryan.

MORE FROM THIS COLLECTION

English

English