India’s growing role in diversifying semiconductor supply chains

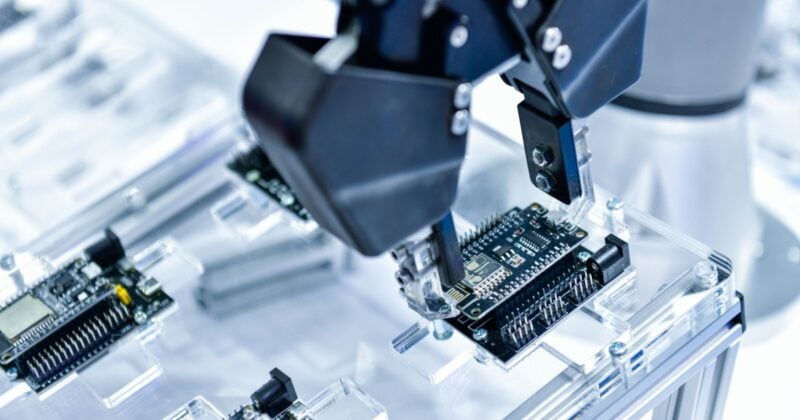

Semiconductors are the foundation of modern innovation, underpinning the progressively more complex technologies needed in today’s digital world. Demand for them is accelerating as advancements in artificial intelligence (AI), high-performance computing, 5G communication, and the Internet of Things reshape industries and infrastructure.

Asia Pacific (APAC) is especially well-positioned to benefit from this growth. The region accounts for about 75 percent of the world’s semiconductor manufacturing capacity and almost 90 percent of its chip assembly, test, and packaging (ATP) capacity, making it the backbone of the global chip supply chain.

However, new United States (U.S.) tariffs on Chinese electronics and technology components are now prompting global semiconductor and tech firms to reassess their manufacturing and ATP footprints in the region. In response, companies are increasingly focused on diversifying supply chains to reduce geopolitical exposure and enhance resilience.

For many, India – a strategically independent, politically stable nation that can meet global demand at scale – offers the geographic and geopolitical diversification they seek. But as enterprises seek to explore manufacturing opportunities, understanding the landscape and market, especially from a regulatory perspective, and identifying the advantages and practical challenges of such a move is a vital first step.

India’s advantage: capacity and commitment

India’s government has also demonstrated a serious long-term commitment to growing its semiconductor sector. To date, it has pledged over US$26 billion in manufacturing subsidies, including US$2.7 billion earmarked for electronics and semiconductors in 2025 alone.

Flagship initiatives include the Semicon India Programme, launched in 2021 with an initial incentive package of US$10 billion to attract investments from both domestic and international firms. There is also the India Semiconductor Mission, which recently announced it was investing more than US$15 billion in building three new semiconductor plants.

Navigating challenges

Despite India’s great strides in growing its semiconductor sector, certain challenges persist. For example, a shortage of skilled labor and barriers to technology transfer, such as concerns over stringent intellectual property protections, remain key hurdles for new entrants.

Additionally, India’s stance on digital trade, including proposals to impose duties on cross-border data transfers, has raised concerns among global chipmakers about potential impacts on operational flexibility and innovation.

Understanding India’s infrastructure – and how to build agile, compliant supply chains – can also be challenging for new entrants. Issues include limited specialized handling facilities, inconsistent road and port connectivity, and capacity constraints at key logistics hubs. These factors can impact the speed, reliability, and scalability of semiconductor manufacturing and distribution.

These, coupled with increasingly complex export control requirements, primarily from the U.S. on the sale of chips, particularly high end ones, mean that overlapping regulations across jurisdictions make supply chain planning compliance a challenge.

Start strong with a trusted logistics partner

Partnering with an experienced logistics provider is a crucial step when entering a new market.As a trusted global logistics partner, DHL Express plays a pivotal role in helping companies safely accelerate their entry into the Indian market.

A leading global semiconductor company set its sights on establishing a manufacturing facility in India, recognizing the country's vast potential and growing demand for advanced electronics. However, the path to entry was far from straightforward. The company encountered a series of formidable hurdles, including navigating India’s complex regulatory environment and deciphering the intricacies of the local logistics landscape—especially critical for ensuring seamless integration with its existing manufacturing operations in China.

Using its decades of global experience in managing high-tech device and electronics supply chains, DHL Express offered the tools and insights to help the company operate effectively in a high-stakes manufacturing environment, meeting the precision, speed, and security required for its logistics needs.

The logistics firm’s strength is multi-faceted. Its long-standing presence in India and deep operational knowledge of local conditions give businesses an inside track to confidently navigate customs procedures, tax compliance, and complex cross-border regulations.

Regulatory requirements have become more important than ever, given the ever-shifting geopolitical landscape and changing tariffs. “When you look at your supply chain set-up, the understanding of what regulations impact you across your trade footprint is something companies need to stay very close to,” said Raymond Yee, Vice President for Customs & Regulatory Affairs, DHL Express Asia Pacific. “Our team tries to get as much information about what’s happening on the customs and regulatory front and give customers a heads-up, but companies also need to do their own homework.”

With the right logistics strategy in place, semiconductor firms can move faster, operate smarter, and scale more confidently in India’s rapidly evolving electronics ecosystem. DHL Express enables just that – delivering not just goods, but competitive advantage.

Supporting FDI and ecosystem expansion

Additionally, India is seeking to catalyze significant foreign direct investment (FDI) in its semiconductor sector through research and development (R&D) partnerships. To this end, it has signed Memorandums of Understanding with countries including Singapore, Japan and the U.S. as well as the European Union.

At the same time, it is focusing on expanding its fabrication and ATP capabilities. Notably, Micron Technology is investing US$2.75 billion to establish an assembly and testing plant in Sanand, Gujarat, which is projected to create approximately 5,000 direct and 15,000 indirect jobs.

These developments underscore the government’s strategic drive to build a full-stack electronics ecosystem – spanning R&D, chip design and fabrication, and device assembly – across the entire semiconductor value chain.

An expanding role in the global electronics supply chain

In India, a range of Production-Linked Incentive schemes for electronics, smartphones, IT hardware, and telecom components have been instrumental in reducing cost barriers and enhancing export competitiveness.

Such schemes are helping India successfully demonstrate its ability to assume a larger role in global electronics and technology manufacturing supply chains. The country is already the second-largest mobile phone producer globally, with mobile phone exports reaching US$15.6 billion in the 2023–24 fiscal year.

This growth has been underpinned by the establishment of over 300 manufacturing units – up from just two in 2014 – and a significant rise in domestic consumption. As of December 2024, 99.2 percent of the mobile phones sold in India were being locally made.

Analysts are taking note: India’s semiconductor market is now projected to reach US$64 billion by 2026 and nearly double to US$110 billion by 2030.

Growing momentum from industry leaders

This strong momentum is being further reinforced by major global technology firms expanding their operations in India.

For example, Apple recently announced a US$17.5 million investment in its India manufacturing unit, and is scaling up its production footprint there through partnerships with Tata Electronics and Foxconn. Both companies import component sets from China and assemble iPhones locally. Foxconn alone exported US$1.3 billion of Apple devices from India to the U.S. in March 2025.

Media reports also suggest Samsung is evaluating moving smartphone production from Vietnam to India, prompted by new tariffs on Vietnamese imports. Alphabet Inc., Google’s parent company, is likewise reported to be in discussions with manufacturing partners such as Dixon Technologies and Foxconn to relocate part of its Pixel smartphone production from Vietnam to India.

Meanwhile, NXP Semiconductors and Lam Research are among the leading semiconductor companies that have announced substantial new investments in India.

These early movers validate India’s viability as a hub for high-value electronics manufacturing and set a precedent for others to follow.

ALSO WORTH READING

English

English