Back to normal or damp squib?

The famous old joke starts with the question: “Do you want the good news or the bad news?”

In the case of air freight markets, as we head into what should be the peak season, the most recent ‘good’ news came from IATA which at the start of October reported its global August volumes and outlook. This came with a bold headline proclaiming that annual air cargo demand rose 1.5 percent in the month, the first annual growth since February 2022.

This seemed to support earlier signs of ‘good’ news in late September when air freight rates ticked up.

However, the bad news is that in both cases, caveats abound.

“Overall, there has been moderate demand strength, and we’re seeing minor month-on-month increases in volume levels, with a slight improvement in Q4 2023,” said Niki Frank, CEO, DHL Global Forwarding Asia Pacific. “But shippers should still exercise prudence and prioritize clearing any backlog inventories.”

Mixed market signals

Amid the run-up to what should be the peak season, the air cargo market is experiencing mixed market signals. IATA itself quickly made the point that its August headline numbers for cargo ton-kilometer demand were read against the very low year-on-year comparison for August 2022.

“This is the first year-on-year growth in 19 months, so it is certainly welcome news. But it is off a low 2022 base and market signals are mixed,” said Willie Walsh, IATA’s Director General.

Elsewhere, the Association of Asia Pacific Airlines (AAPA) reported that international air cargo demand — measured in freight ton-kilometers (FTK) — dropped 1.8 percent year-on-year in August with renewed declines in export orders cited as a key factor.

Subhas Menon, AAPA Director General, said Asian airlines saw a “record” 7.6 percent decline in international air cargo demand in the first eight months of the year, reflecting prevailing weakness in international trade flows. He further added that the normalization of container shipping rates affected demand for air shipments of non-time-sensitive goods.

J.P.Morgan reported that global economic growth remained “lackluster” at the end of the third quarter with signs of further weakness in the coming months, as backlogs of work fell sharply and business optimism dipped to a nine-month low.

“The decline in the all-industry new orders index to a level below the 50-mark adds further to downside risks,” said Bennett Parrish, Global Economist at J.P.Morgan. “Both the manufacturing and services new orders PMIs have fallen below the output PMIs of late, suggesting continued weakness in the coming months. Indeed, the all-industry future output index looking six months ahead declined almost a full point in September."

An unconventional peak season

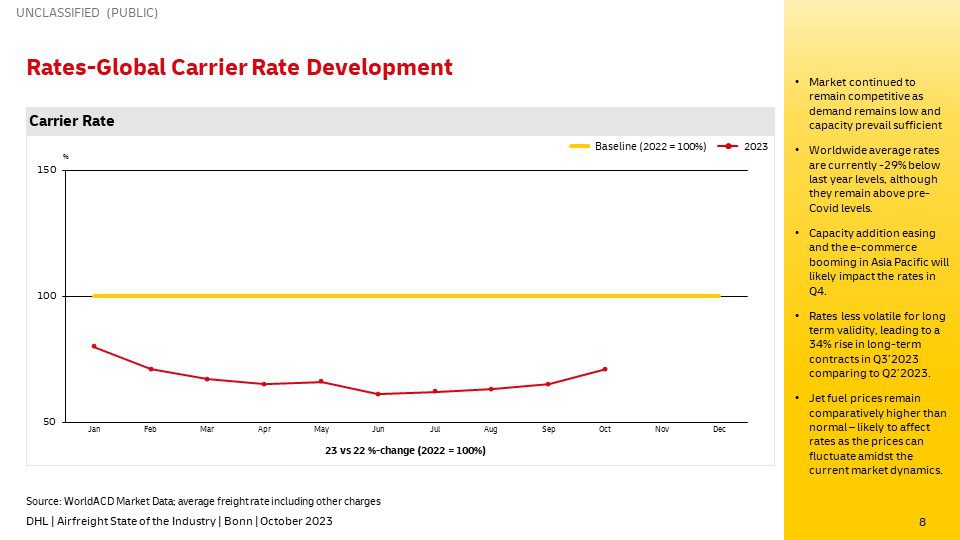

Meanwhile, global air freight rates have also tapered downward. TAC Index reported that the overall Baltic Air Freight Index fell by 2.3 percent in the week before 16 October, leaving it down 32.3 percent compared to a year earlier.

The DHL Hong Kong Air Trade Leading Index (DTI), commissioned by DHL Express Hong Kong and compiled by the Hong Kong Productivity Council, predicts air trade will remain soft in the fourth quarter. However, as the year-end peak season of Thanksgiving and Christmas approaches, local air traders told DTI that they are expecting a ‘better’ peak than last year, enabling the Index to reach the same level as Q4 2018.

Niall van de Wouw, Xeneta’s chief airfreight officer, on the latest Freight Buyers’ Club podcast attributed the recent jump in air cargo prices to seasonal increases that routinely occur between a slow August and September. He remained bearish about anything other than a disappointing peak season for operators.

The October 2023 edition of DHL’s Air Freight State Of The Industry also concludes that a “traditional peak season surge is not to be expected”.

However, there have been signs that new product lines launched by technology companies are boosting demand on some trade lanes out of Asia, and there remains some optimism that November could yield higher demand. The Loadstar reported that the daily average volume of air cargo handled in Johannesburg was up 107 percent during October, with rates on many lanes going up by double digits.

Frank explained that this peak season needs to be put into context. “We are seeing increased demand, and we are still experiencing a peak season, it’s just rather stable and undramatic,” he said.

Looking forward to 2024

The DTI survey found that looking further into 2024, nearly half of the local air traders will increase their prices.

It noted that Asian markets are set to shine in 2024, with air traders finding Southeast Asia, especially Vietnam, Malaysia, and Thailand, and China, to be the top potential markets in the coming year. This is unlike last year when the U.S. and European markets were on top of the list.

Bruce Chan, Stifel’s Director and Senior Research Analyst covering Global Logistics and Future Mobility, said in early October that recent rate increases were a positive indication that could suggest a stabilizing market, but added that it might be premature to celebrate.

With inflationary pressure and rising energy prices putting a strain on consumer discretionary spending, the likelihood of a breakaway restocking is unlikely. And although inventories might seem to have bottomed out for the most part, the risk of fundamental demand grinding lower, coupled with the memory of last year’s overstocking, will likely lead shippers to position conservatively.

“The air cargo market is recovering, albeit very slowly. Global capacity has risen by 5 percent compared to October 2022, and has been consistently rising since March,” noted Frank. “Particularly in Asia, the strong demand for e-commerce and technology are tightening up capacity. If this trend persists, we could be looking at improved volume growth next year.”

ALSO WORTH READING

English

English