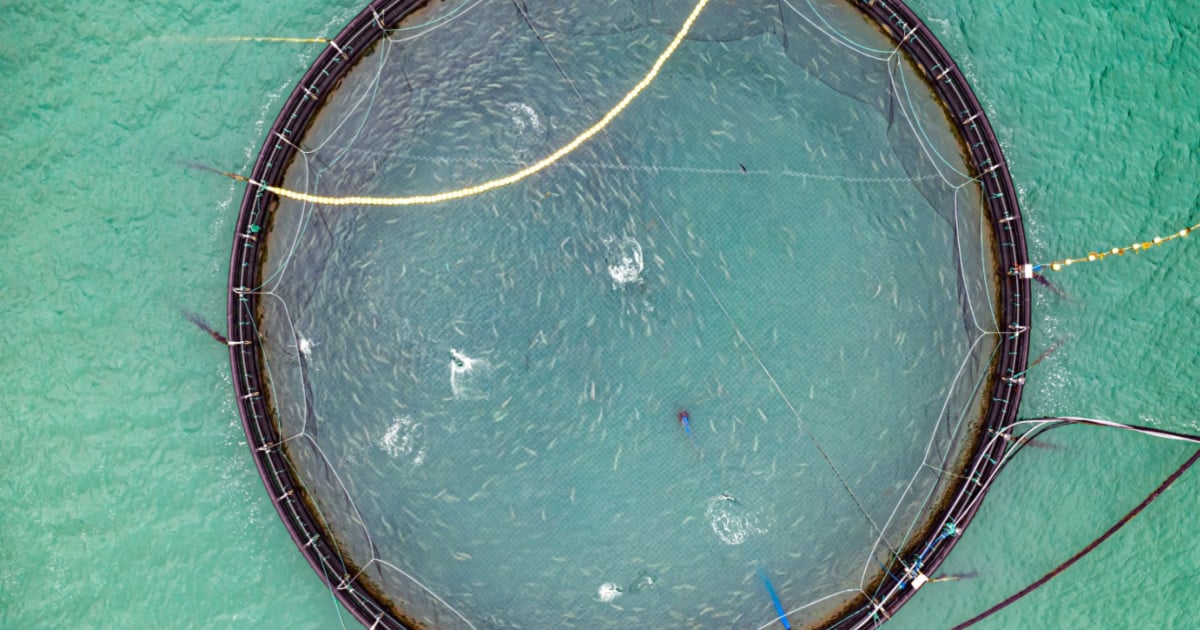

澳大利亚塔斯马尼亚的南部海域能成为三文鱼养殖基地的原因如下:这片水域较为干净,没有影响洄游性鱼类的常见疾病,水温适中,足够让三文鱼在18个月内生长到适合捕捞的程度。

但这片水域如此适合三文鱼生长繁殖,也意味着它远离了主要的航运枢纽。因此,即使是在最顺利的情况下,如何把这里的三文鱼送到市场上也成了一个难题。而新冠疫情的影响让三文鱼的物流运输变得难上加难。一方面是飙升的市场需求,而另一方面则是可选的物流方式很少,进退两难的养殖户不得不与当地的DHL伙伴合作,寻求创造性的解决方案。

从中总结到的经验:每一个强大的物流网络建立的背后,都是人们为了完成工作而进行自适应调整、发挥创造性、积极展开合作的过程。

塔斯马尼亚三文鱼生产的历史背景

自上世纪80年代以来,三文鱼养殖业在塔斯马尼亚兴起,而全球三文鱼产业已经变成了世界上发展速度最快的食品生产系统之一。水产养殖,即在水中进行养殖,成为全球最主要的三文鱼生产方式,其产量超过了野生捕捞产量。截至2018年,水产养殖的三文鱼产量占全球三文鱼总供应量的69%。

目前,全球食品生产市场不断增长,而全球三文鱼消费量占其中的70%,即250万吨,与30年前相比增长了三倍。

在澳大利亚,多个三文鱼养殖场坐落在塔斯马尼亚的蓝色海岸线上,澳大利亚全国90%的三文鱼产量都来自这里。

塔斯马尼亚三文鱼运输

三文鱼极易腐烂变质,因此在其运输过程中,如何控制时间和温度等就变成了至关重要的问题。为了减缓有害微生物的生长繁殖,制造商经常在运输前就把三文鱼冷冻起来。

然而,如果储存方式不当或运输过程稍有不慎,三文鱼会迅速腐烂变质,导致在运输过程中就发生损失。

出口商需要先将三文鱼从塔斯马尼亚岛的最南边运到北边,然后才能将三文鱼销往主要的国内和国际市场。

然后驳船穿过巴斯海峡,将三文鱼运往澳大利亚大陆。之后是海运和陆运结合,人们先用船把这些鱼运往墨尔本和悉尼的主要港口,再用车把它们运到这些城市的各个市场。整个物流运输过程需要24小时,中间几乎容不得一丝一毫的差错。

例如,为防止变质,三文鱼的包装必须保持恒温,不得受损。船舶运输公司还必须警惕一些不可预见的事件,例如海关流程延迟和港口滞留等,在运输过程中,这两类事件会让本就易腐烂变质的三文鱼的新鲜度大打折扣。

激烈的竞争

六年前,澳大利亚三文鱼的生产具有较高的季节性,每年8月到次年1月为生产高峰期,三文鱼出口量最大。然而,这种季节性生产意味着,每年余下的时间里几乎没有三文鱼可供出口,因为鱼儿也需要时间来慢慢长大。

相比之下,在三文鱼产业中,澳大利亚最强大竞争对手——挪威早在上个世纪70年代就已经看到了三文鱼养殖的商机。挪威最早的三文鱼养殖户是来自希特拉岛(Hitra)的Grøntvedt兄弟。他们发现三文鱼的数量减少,于是决定使用浮动网箱捕捉野生三文鱼。

在网箱里养殖的三文鱼既能获得正常的饲喂,又不受天敌的侵扰,从而得以大量繁衍,Grøntvedt兄弟很快就发现,在网箱中饲养三文鱼能让他们赚得钵满盆满。

挪威在三文鱼养殖方面有着丰富的经验,在这些经验的基础上,挪威建立了更完善的三文鱼养殖基础设施,可以全年生产三文鱼。这又给澳大利亚提出了一个难题,他们需要紧跟竞争对手的步伐,将鱼品推向全球市场。

尽管如此,过去10年,澳大利亚三文鱼生产商纷纷效仿挪威的生产模式,还取得了显著的成效,几乎全年都有稳定的三文鱼产出。

DHL Global Forwarding澳大利亚区易腐品和牲畜部经理Bernie Cooney表示:“澳大利亚三文鱼的季节性断货已经从以前的6到7个月缩短到大概3到4个月,而在未来5到6年内,随着三文鱼产量的增加,季节性断货的时间会越来越短。”

疫情期间三文鱼人气高涨

近年来,随着塔斯马尼亚三文鱼的营养价值渐渐得到重视,以及人们的消费方式发生转变,塔斯马尼亚三文鱼登上了全球各地人们的餐桌。事实上,由于塔斯马尼亚的三文鱼水产养殖业蓬勃发展,在这个资源丰富的岛屿上,大部分海鲜和水产养殖劳动力都从事和这个产业相关的工作。

然而,即便三文鱼产量稳步攀升,塔斯马尼亚养殖户也从不会在质量问题上作出妥协,他们以提供最新鲜的塔斯马尼亚三文鱼为荣,无论在物流运输上要面临多少困难。

起初,冷冻三文鱼主要通过海运运输,而鲜鱼则通过空运运输。然而,新冠疫情加剧了港口拥堵等问题,鲜鱼无法及时送达市场,无奈之下,许多养殖户只能把自己的产品冷冻起来。

此外,由于澳大利亚航班运力严重不足,养殖户只能将大部分三文鱼运送到数百公里外的特定机场,特别是大部分航班仍然正常运行的悉尼,才能通过空运把这些三文鱼运送出去。疫情期间,如此辗转的运输过程,让塔斯马尼亚三文鱼走向国际市场的脚步变得异常艰难。

面对这样的局面,塔斯马尼亚的渔业和物流供应商DHL明白:这个时候,他们需要发挥创造力,合作探索更多运输渠道。

竭尽全力,迎难而上

DHL利用关系网,确定了几家可以合作的空运运输公司。因为澳大利亚国内仍有着旺盛的进出口需求,DHL希望对任何进入澳大利亚的新包机航班都能做到物尽其用,也就是说飞机飞澳大利亚一趟不仅仅是为了运输三文鱼,还可以运输其他货物。

Cooney说:“我们想的是如何充分利用飞机的往返运力,而不是仅仅包机来单程运送三文鱼。”

为确保空运业务更顺畅地运作,DHL与合作伙伴网络在往返航线上进行合作,让飞机将进口货物带入澳大利亚,然后包机出口三文鱼等商品。

飞机把食品从欧洲和美国运送到香港后,会被包机送往悉尼,装上三文鱼和普通货物后,飞回北半球,把三文鱼和其他货物运送到上海等主要市场。

为了通过包机的方式,将普通货物从中国运到澳大利亚,DHL聘请了一个合作伙伴网络,该合作伙伴的现有航线可以从布里斯班飞到台北。通过这条航线,飞机可以先将普通货物从上海运到布里斯班,然后再飞回台北。

这种运输方式不仅重振了澳大利亚运输渠道,而且在航班运力减少的情况下,也能让DHL合作伙伴网络的航班进出澳大利亚。

对于三文鱼出口商而言,这种运输方式能帮他们省下不少钱,因为这些飞机往返于主要市场之间,用来输送不同货物的成本会更低。

自此,DHL与其合作伙伴网络也在其他普通货物航线上展开进一步合作。这些航班通常从布里斯班起飞。

前景光明

因为挪威三文鱼的产量高于澳大利亚三文鱼的产量,所以挪威三文鱼的价格通常会更低一些。然而,受中国疫情封控措施和俄乌冲突的影响,挪威三文鱼的额外成本有所增加,价格也因此被推高。

因此,澳大利亚三文鱼和挪威三文鱼之间的价格差距有所缩小,这有利于提高澳大利亚三文鱼的市场竞争力。目前恰逢收获淡季,可供出售的三文鱼数量减少,澳大利亚三文鱼行业略显平静。

尽管新冠疫情对旅游业和货运行业的影响尚未消退,但Cooney表示,与新冠疫情爆发之前相比,航班运力的前景可能会更加稳定。

“疫情之前,从澳大利亚起飞的航班数量有2000次。截至今年6月,这一数量大约为940次。”Cooney表示,“因此,与疫情刚开始时的300次起飞航班相比,我们的航班运力肯定已经大大增加。”

Cooney总结了一点简单的经验:“要能随机应变,要具有创造性。”库尼强调,“如果你做不到,那别人会做得到。”

简体中文

简体中文