绿色黄金:澳大利亚牛油果市场持续增长

新冠疫情的肆虐冲击着各行各业,但我们很难直接评估该冲击及其长期影响。

以牛油果为例:一方面,它被称为预防新冠的神果,广受消费者喜爱;另一方面,它也警示着绿色黄金从种植到餐桌的微妙差别。

全球牛油果趋势

牛油果富含健康脂肪和油脂,因营养丰富而闻名。新冠疫情使得人们更加注重健康,而牛油果也因此变得更受欢迎。

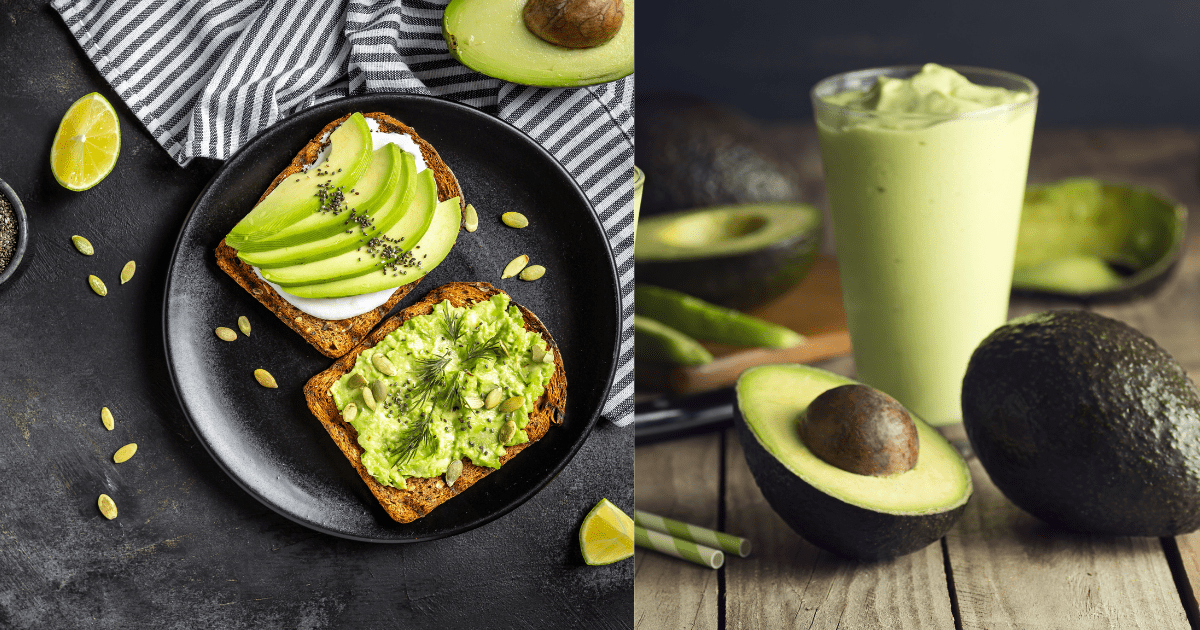

牛油果食用方法多种多样,通常可与吐司搭配、制成沙拉、也可以捣碎或混合制成蘸酱和奶昔。牛油果籽油还是一种健康的食用油替代品,也越来越受消费者的青睐。

随着国民消费水平的提高,牛油果的作物价值呈指数增长。东非和尼日利亚的农民称之为“消除贫困的解药”。中国农民已经开始种植牛油果以应对日益增长的国内需求,墨西哥的贩毒集团甚至抢夺农民种植的牛油果来谋利。

根据《OECD-FAO农业展望报告2021》,牛油果的全球产量现已能满足不断增长的需求。2020年,牛油果的全球产量高达806万公吨,比2000年的271万公吨增长了差不多两倍。

到2030年,牛油果将成为全球出口最多的热带水果。

然而,种植牛油果非常耗费精力。牛油果果肉娇嫩容易碰伤,生长成熟周期长,却又极易变质腐坏。牛油果的种植成本也是出了名的昂贵,平均每英亩土地生产10万磅牛油果就需要消耗100万加仑的水。

由此可见,满足牛油果的全球需求也并非轻而易举之事。

疫情期间克服重重困难

新冠疫情更是雪上加霜,但不同国家遭受疫情的短期和长远影响各不相同。对澳大利亚来说,过去两年无疑是动荡不安的两年。

疫情爆发前,澳大利亚牛油果运输的航班运力即便在收获旺季也可以得到保障。但疫情封锁期间,澳大利亚港口拥堵、航班停飞,导致出口产品的运力严重不足。

在这种局势下,澳大利亚只能靠国民消费来内部消化牛油果。但内销也不太可行,因为早在疫情爆发前,澳大利亚种植牛油果树的人口剧增,导致市场上的牛油果供过于求。

众所周知,牛油果不太好伺候,因其生长消耗大量水分,种植难度和成本都比较高。

“尤其是在西澳大利亚州和东海岸,越来越多的农民在自己的空地上种植牛油果树。由于需求激增且回报率也在飙升,和五年前相比,现在市场上的牛油果种植者数量几乎翻了一番,”DHL Global Forwarding澳大利亚区国家易腐品和牲畜部经理Bernie Cooney说道。

特别是2017年和2018年,澳大利亚刮起了一股牛油果种植潮,每年种植面积扩大超过100公顷。这可能会影响未来十年的牛油果价格,因为一棵牛油果树一般需要六年才能成熟结果。

与此同时,尽管种植者从规模经济中获益,牛油果价格却一跌再跌。这对消费者来说是个好消息:2022年,每个澳大利亚家庭的牛油果消费量同比增加了31.2%,而平均支出却同比减少了29%。

另一方面,种植者正面临牛油果供过于求的严峻局面,这使得牛油果交易价格比近五年平均水平低了47%。

大量新加入的种植者

牛油果种植者需要把握和预测市场趋势,才能应对当前和长期的挑战。但这也正是许多经验不足的种植者所欠缺的能力。

“很多在好年景进入市场的新种植者希望之后每年都能获得同样的高收益,但遗憾的是,现实并非总是如此,”Cooney说道。如果牛油果上一年的产量高,那么下一年的产量就会相对较低。

“如果遇上大丰收季节,澳大利亚内销剩下的大量水果只能外销,但外销的收益相对较低,果农的利润空间就会缩减,”Cooney解释说道。“但是果树存在大小年现象,这意味着次年牛油果的产量会缩水,价格会变高,农民就会获得更高的收益,”Cooney补充道。

过量种植牛油果树致使牛油果过剩,导致果农利润减少。

为了更好地把握和预测市场波动,DHL Global Forwarding团队与果农和承运商密切合作,在每年牛油果收获之前加强规划。现如今,早在收获季节开始之前,果农就开始预测牛油果出口各国的情况。

“疫情改变的不仅仅是我们的运营方式。承运商还必须更加严格地规划运输舱位,这意味着我们现在需要提前四至六周预测我们所需的舱位,但之前我们并不需要这样做,”Cooney说。

事实上,新冠大流行促使行业内发生了一些更深刻的变化。例如,一些牛油果种植者和包装商在疫情停工期间审查了自己的供应链并升级了设备。The Avocado Collective是澳大利亚最大的牛油果包装公司,投资了

100万澳元在满吉姆建造了一个密封的冷对接工厂,以满足日益增长的出口需求。

澳大利亚有必要平衡国内需求和出口,尤其是在旺季。按照以往惯例,澳大利亚95%以上的牛油果用于内销。但由于供应过剩,挤压国内市场的利润,种植者正转向出口以获得更高的利润。

“我们当然不想把大量产品出口到另一个国家,这会冲击他们的市场,使产品贬值,”Cooney警告说。“对于新鲜水果,我们希望确保能够按时按量运送,并尽可能保持水果最好的状态送至目的地。”

因此,控制牛油果的成熟过程是其物流的关键环节。鉴于牛油果难保存的特点,供应商花费大量的精力来测量甚至控制牛油果的成熟时间。“牛油果对某些水果成熟时产生的乙烯气体非常敏感。所以供应链从头到尾都需要把牛油果与其他水果分开储存,”Cooney补充说道。

DHL Global Forwarding澳大利亚团队使用可控气氛(CA)冷藏集装箱,将牛油果冷冻运输。通过CA集装箱运输,种植者可以更好地控制牛油果的供应,保证牛油果以一致的价格稳定地输送到世界各地的商店。

适应当地市场需求

除了满足这些基本要求之外,牛油果还必须满足不同市场的进口条件。例如,日本农林水产省(MAFF)要求进口产品必须满足“有条件的非寄主”条件。这意味着牛油果需要在成熟之前采摘,同时避免果蝇。牛油果也需要冷藏,并用托盘护罩或防虫包装单独包装。

日本由于担心昆士兰果蝇的入侵而限制了澳大利亚牛油果的进口。目前,只有在没有昆士兰果蝇的地区生长的牛油果(包括西澳大利亚州、塔斯马尼亚州和河地产区)可以进入日本市场,这意味着澳大利亚一年只有一半时间可以向日本供应牛油果。

为了进一步占领日本市场,供应商必须首先建立符合日本要求的包装线。Cooney指出,虽然执行起来困难重重,但是澳大利亚很可能会满足日本的市场需求,尤其是因为日本市场愿意承担牛油果进口的附加费

“这确实需要一些培训,但程序不太繁重。我们在珀斯的工厂有八个不同的车间,配有齐全的设备,能相应地分离牛油果。我们明白防止害虫通过海外进口进入本国农业系统的重要性,所以我们要做的就是适应日本市场,”Cooney说道。

牛油果的未来

显而易见,新冠疫情带来的剧变让一些关键问题浮出了水面。种植者的应对有助于制定一条有利于整个行业长期发展的道路。随着全球牛油果市场的扩大,澳大利亚的种植者认识到,出口外销对整个行业的可持续经营至关重要。虽然新种植者在行业知识方面有所欠缺,但经验丰富的公司,比如The Avocado Collective,会教会他们如何找到种植收益的平衡。

据Avocados Australia称,与新冠肺炎疫情前的出口量相比,澳大利亚的牛油果的出口量增长了350%。2021年西澳大利亚州出口的牛油果中,有50%以上来自首次出口的种植商。

Cooney表示,“由于牛油果的出口增长迅速,教育培训变得十分重要。种植者应该把握市场脉络,找到可持续发展的平衡,以便适应新市场。”

简体中文

简体中文