More volatility than help from tariff deadline extension for Transpacific route

Tariff uncertainty has turned Transpacific container shipping demand into the faulty tap of global trade – hot one moment, freezing the next.

What began as pauses in April—designed to give the U.S. time to negotiate new trade deals—combined with a temporary tariff truce with China in May, led to a surge in early summer container shipping demand. This saw spot freight rates soar, including a 1.5-fold increase on routes from China to the U.S. East Coast in just a month.

However, the rally derailed as new tariff deadlines in July and August approached. By early July, most of the gains in spot markets on the eastbound Transpacific trade had been lost, with analysts predicting further declines even as carriers started removing capacity.

With shippers holding back shipments while awaiting tariff policy clarity, carriers have been hurriedly putting in motion plans to cut shipping capacity on the route by over 20 percent to stem the decline. However, there was little sign of the strategy proving successful in the second week of July.

"Carriers rushed to add capacity on the Transpacific to chase early gains, but oversupply is becoming apparent as the momentum fades," said Niki Frank, CEO, DHL Global Forwarding Asia Pacific. A wave of blank sailings, coupled with niche carriers moving operations into better performing markets, is likely to happen. “With this in mind, we are ready to adapt swiftly to an ever-changing situation, seeking an optimal balance between demand and capacity for customers,” assured Frank.

Schedule reliability see-saw

In a sea of volatility, the spotlight shines on schedule reliability improvement. For shippers, the direction of travel on carrier schedule reliability continues to provide positives. In May, maritime analysis firm Sea-Intelligence reported a 7.4-point monthly improvement, reaching 65.8 percent. Maersk was the most reliable carrier with a schedule reliability of 75.9 percent, followed by Hapag-Lloyd with 72.5 percent. The May gains continued the trend of consistent month-on-month improvements noted since February this year. Versus a year ago, schedule reliability was 10 percentage points better.

While the improvements sing a positive note, DHL's July Ocean Freight Market Update noted that shippers are singing a different tune, experiencing service delays affecting cargo flows, particularly on key routes between Asia, Europe, and North America.

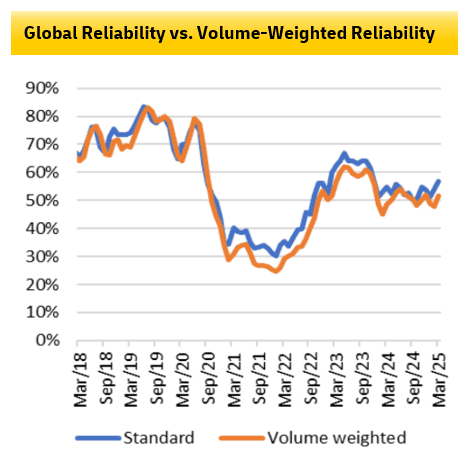

An analysis using a volume-weighted approach that calculates reliability based on TEU volumes across 34 trade lanes shows a widening gap between traditional vessel reliability measures and shippers' actual experiences, especially since early 2025.

Although cargo reliability improved from September 2022 to September 2024, it reversed after October 2024, resulting in a reliability 4.7 percent worse than the traditional measure, and 5.4 percent worse in March 2025. Additionally, average cargo delays have increased, with shippers experiencing delays 0.2 days longer than indicated by standard measures in March 2025.

Trade positives beyond the U.S.

While the U.S. constructs high walls around its economy, there are positive signs that trade is finding more receptive paths and increasingly bypassing the U.S. market. China’s exports to the U.S. are down 9.7 percent this year, while its shipments to the UK, ASEAN and Africa rose to 7.4 percent, 12.2 percent and 18.9 percent respectively.

According to Lars Jensen, CEO, Vespucci Maritime, cargo loaded in May has shown that global demand grew 1.8 percent. “That doesn't sound like much, but where it becomes real interesting is if I take all cargo in all the world, except for North America, global demand grew 5.6 percent which is nice, decent, solid growth, and in line with what we have seen for quite a while,” noted Jensen. Mirroring this trend are the rates and demand levels on the Asia-Europe lane, where trade appears to be tracking toward a more traditional Q3 peak. General Rate Increases at the start of July were partially successful on Asia to North European services, and rates were 50 percent higher in early July than at the end of May. For the first time in 2025, Asia-Europe container rates have overtaken Transpacific US West Coast prices.

"We're seeing a clear split in global trade patterns,” said Praveen Gregory, Senior Vice President, Ocean Freight, DHL Global Forwarding Asia Pacific. “While U.S. routes remain volatile and policy-driven, other corridors are showing healthy growth.”

The growth, however, also comes with added challenges for ports experiencing the knock-on effect of the June shipment surge. The data as of 12 July from Linerlytica shows no improvement in North Europe, with waiting times rising as high as seven days as Rotterdam and Antwerp. Congestions at major North American ports, especially at Los Angeles and Long Beach, are seeing 4 percent of capacity tied up. In Asia, congestion is rising, particularly in North Asia, where 36 percent of capacity is affected.

Among this scene is another developing situation, where the number of returning empty containers has risen 40.9 percent since the pre-pandemic period, while full container shipments have increased only 9.7 percent. This imbalance raises costs and creates operational challenges, thereby increasing the risk of temporary equipment shortages.

All eyes on Washington

Any shifts, for better or worse, in the above situations will be determined by the White House. During the 90-day pause, the U.S. has only managed to reach new trade agreements with China, Indonesia, the U.K. and Vietnam, and the deals fall far short of being comprehensive free trade agreements. Certain tariff rates, which were initially set to expire on 9 July, have been given an extended deadline to 1 August. The Trump administrative has issued tariff letters to a select number of major trade partners, informing them of their new reciprocal tariff rates, which will also take effect on 1 August. More new U.S. tariffs are also expected as July progresses.

Relations with China remain precarious, with temporary agreements providing little long-term trade stability. U.S. President Donald Trump warned that countries which side with the policies of the China-led BRICS alliance that he determines go against U.S. interests would be hit with an extra 10 percent tariff.

While the proverbial crystal ball is still showing a level of uncertainty, the shifting trade patterns are a clear sign of the things to come. “We’re seeing companies diversifying their supply chains, and a growing demand on Asia-Europe, intra-Asia, and emerging market routes,” noted Frank. “The global trade engine is restarting and adapting, not stalling."

ALSO WORTH READING

English

English