チッパゲドン:世界的なチップ不足と戦う台湾

5月日本の自動車大手、日産は、自動車生産にブレーキをかけ、2021年の生産生産を50万台削減することを余儀なくされました。その理由は、車両に電力を供給するために必要な、コインサイズのコンピューターチップの深刻な不足でした。

過去18か月間、世界の自動車産業を不自由にしてきたこのチップ不足は、今や他のセクターにも波及しています。しかし、ロジスティクスパートナー間の努力と柔軟性は、危機を緩和し、生産プロセスが将来どのように改善されるかについてのアイデアを提供するのに役立っています。

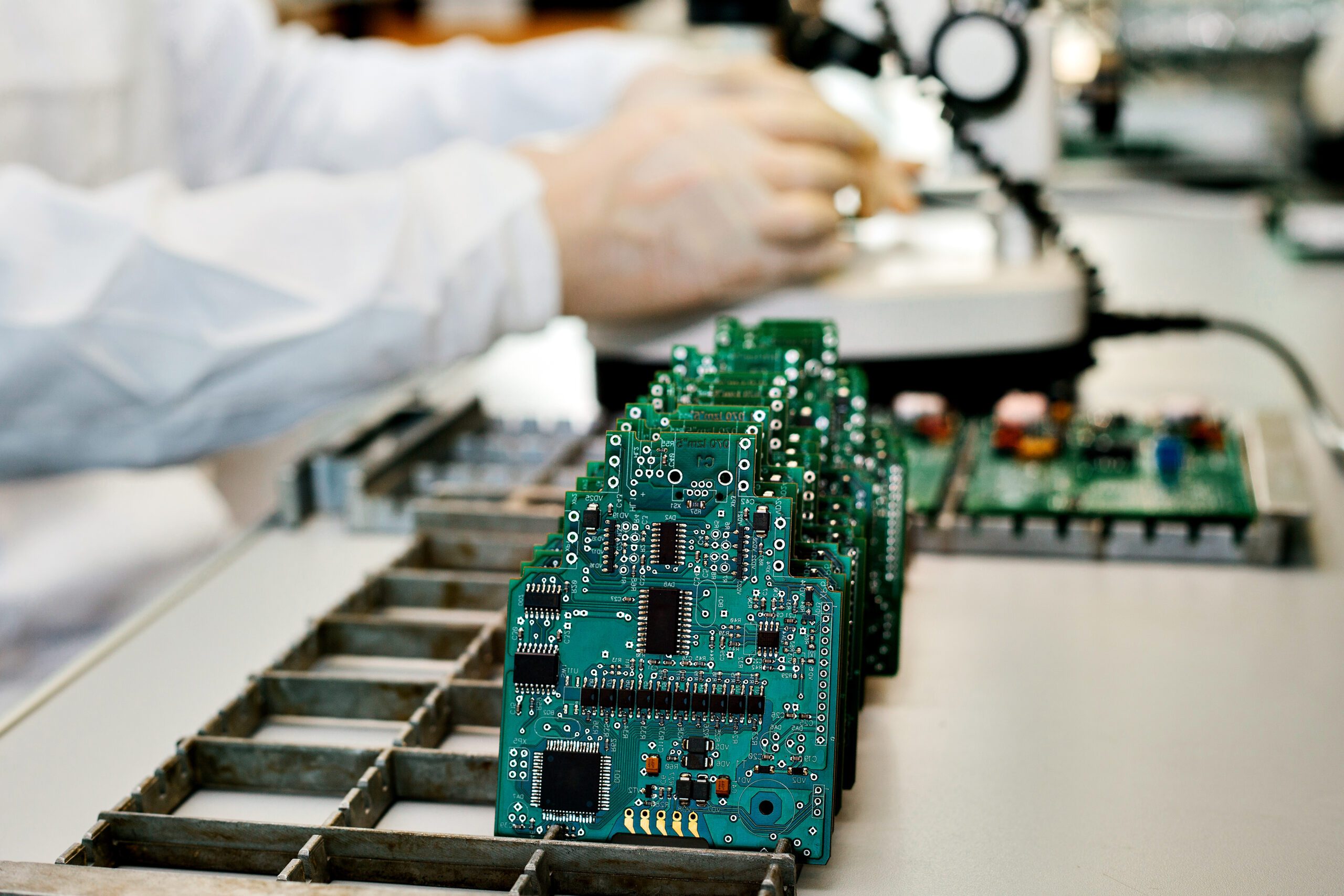

半導体としても知られるチップは、現代の力となっています。電話、車、目覚まし時計など、ほとんどすべての電子機器の機能は、これらのナノサイズのシリコンウェーハに依存しています。昨年、台湾は半導体受託製造の世界市場シェアを支配し、世界の収益の60%以上を占めました。

「台湾は世界のチップ製造工場です。半導体製造は台湾にとって最も重要な産業のひとつです」と、DHLサプライチェーン台湾のマネージングディレクターであるDJ Shiehは述べています。

しかし、過去1年間に、世界的なパンデミックと半世紀で最悪の干ばつが、台湾の生産をひどく混乱させました。台湾はまた、米国と中国の間の世界的な技術戦争に巻き込まれています。この3重の脅威は、「チッパゲドン」と呼ばれるほど深刻な半導体不足の危機をもたらしました。

「世界的なチップ不足はすべての業界に影響を及ぼしています。供給の急激な減少を予期していたプレイヤーはほとんどいないと思います」とShieh氏は述べています。

「私たちは、半導体の顧客がこのサプライチェーンの危機を最小限に抑え、うまくいけば解決できるように、商品のシームレスな流れを確保するために最善を尽くしています。」

最悪の嵐

新型コロナウイルスのパンデミックは、この世界的な不足のきっかけとなりました。このウイルスは、まず、昨年世界中の半導体工場を一時的に閉鎖させました。それ以来、それは断続的な混乱を引き起こし続けています。たとえば、2021年半ばに台湾を襲った感染の波は、多くの製造メーカーの生産能力に影響を与えました。

「一部の製造メーカーは、工場の清掃、消毒、および従業員の新型コロナウイルス検査のために、2〜3日間の閉鎖を余儀なくされました」とShieh氏は述べています。

6月、世界最大のチップテスト会社の1つであるKing Yuan Electronicsは、48時間の操業停止に見舞われました。この混乱により、その月の生産は少なくとも3分の1削減されたと推定されています。

ほとんどの工場での生産は徐々に再開されていますが、厳格な大量検査と検疫措置の必要があります。遅延は続くと予想されます。

今年、台湾は56年で最悪の干ばつのひとつに見舞われました.これは、Shiehがチップメーカーにとって「最大の懸念」のひとつであると述べた出来事です。この災害は、製造工程で大量の水を必要とする半導体業界に大きな脅威をもたらしました。

しかし、状況は改善する可能性があります。政府は一部のチップメーカーへの給水を15%削減する必要がありましたが、大手メーカーへの影響はそれほどありませんでした。

母なる自然はまた、タイムリーな介入をしました。「今年の半ばに発生した大雨と台風が状況を改善しました」とShiehは付け加えました。

一方でしかし、政治がまた、さらなる障害を生み出しました。米国と中国の間で激化する技術戦争もまた、ますます細分化された世界的なチップ供給に影響しています。米国による制裁措置は、ライセンスと政府の承認が必要になったため、チップメーカーが製品をどの企業にも自由に供給できなくなったのです。

これは、企業がダブルブッキング(安全在庫を確保するために行われた二重予約)を行うことにつながり、不足をさらに悪化させたため、世界のチップ業界に不確実性をもたらしました。

サプライチェーンの強化

影響はすぐに現れました。ピンチを感じた消費者によりチップ価格が上昇、コンピューター、タブレット、さらにはスマートテレビでさえ、価格が30%も高騰したのです。

政府は、韓国、米国、欧州連合が主導するチップ容量を増やすことで迅速に対応しています。しかし、新しい工場が稼働するなるまでには何年もかかるでしょう。

「不足に対処するために、企業はダブルブッキングを取り消し、チップを最も必要とする人々に物資を送ります。このようにして、安全予約をしたいだけの顧客の一部を除外することができます」とShieh氏は述べています。

ロジスティクスは、チップが目的地に迅速かつシームレスに到達するための重要な役割を果たします。これは潜在的な遅延やチョークポイントを軽減するのに役立ちます。

たとえば、不足に対処するには、顧客が急増する需要に対応できるようにするための柔軟性が必要です。 「サービス品質を確保するだけでなく、顧客に着信ツールや部品用の追加のストレージスペースを提供するなど、突発的な要求に迅速に適応して対応する必要があります」とShieh氏は述べています。

また、消耗品が迅速に発送されるように、追加のサービスを拡張していますDHLは、台湾の顧客の生産工場にマテリアルハンドラーを配備して、これらのチップの製造に必要な機密性の高いツールと機械を管理しています。これにより、機械のスムーズな配送と機能が保証されます、とShieh氏は付け加えました。

ロジスティクス企業は、コンポーネントを元の状態に保つために、ツールや部品を洗浄するためのクリーンルームとクリーンベンチも提供しています。ほんの小さなホコリでさえ、チップ全体を破壊する可能性があります。

マンパワーが業界にとって大きな課題であることを認識しているShiehは、自動化および管理ソフトウェアソリューションにより、輸送から組み立てに至るまで、現在の運用の効率と速度が向上すると考えています。

「ソフトウェアの開発をさらに進め、輸送管理システムを改善できれば、間違いなく競争力を高めることができます」とShieh氏は述べ、メーカーは将来の需要を予測し、より良い生産予測を行うためにさらに多くのことを行うことができると付け加えました。

世界的なチップ不足がすぐに解決される可能性は低いですが、ボトルネックを緩和し、配送を高速化し、輸送をスムーズにするための支援は、困難な状況を克服するのに大いに役立ちます。

日本語

日本語