Asia Pacific emerges as a pillar of global trade resilience

Over the past five years, geopolitical upheavals and economic uncertainties have significantly impacted global trade. From climate change and global health crises to inflation, shifting US trade policies, and evolving alliances, businesses everywhere must navigate an increasingly complex and unpredictable landscape.

Despite these challenges, the Asia Pacific region has emerged as a pillar of global trade resilience. In 2024, for example, it outpaced global trade averages, reaffirming its leadership in trade and investment even amid economic turbulence.

This trend is set to continue, according to the latest edition of the DHL Trade Atlas. The report’s 2025 findings highlight that East Asia and Pacific will lead the world in export and import growth over the next five years. Trade volume is expected to account for 34 percent of the world’s trade growth from 2024 to 2029—more than Europe (30 percent) and North America (14 percent).

However, the outlook varies between countries and sectors. “Asia Pacific business leaders must identify the best opportunities and assess how ongoing geopolitically driven shifts in trade patterns may impact future growth and profitability,” said Ken Lee, CEO, Asia Pacific, DHL Express.

Asia Pacific set to continue global trade leadership

The DHL Trade Atlas provides powerful insights into the future—both within the region and globally. This comprehensive report analyzes key import and export data, offering thought leadership and deep insights into trade patterns and trends for nearly 200 countries and territories.

Its 2025 findings show how Asia Pacific’s contribution to global trade has continually increased, rising from 26 percent in 2000 to 33 percent in 2024. That growth looks set to continue, driven largely by its strengths in regional integration and supply chain diversification.

Fueled by the rise of its emerging economies and the opportunities this creates for cross-regional exchange, Southeast Asia will achieve the fastest trade volume growth in the next five years, with compound annual trade volume growth rates of 5–6 percent. All other regions are forecast to grow at rates of 2–4 percent.

Long-distance trade will continue to expand

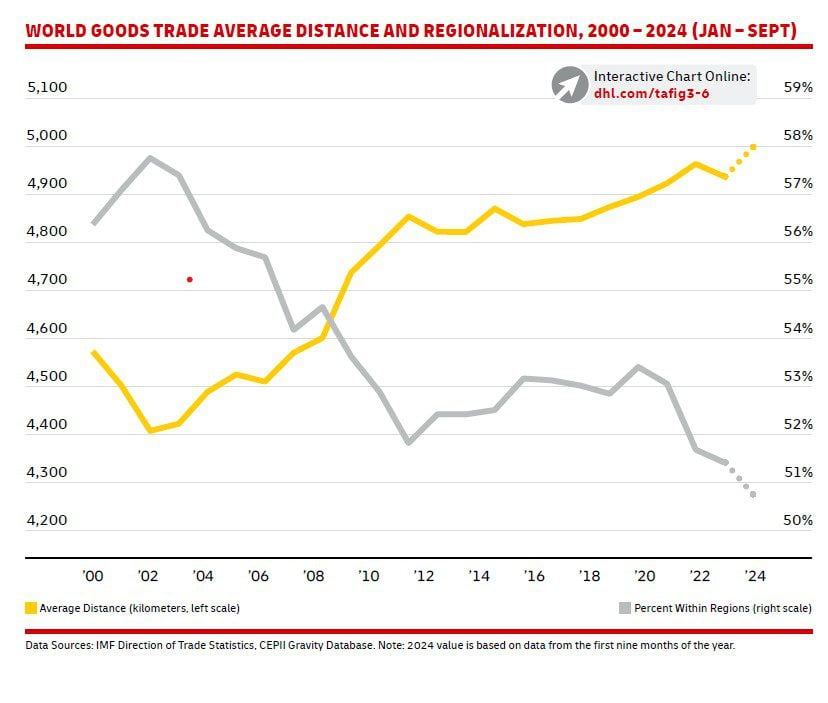

The Atlas also highlights that global trade has not become more regionalized despite widespread interest in ‘nearshoring’ and producing goods closer to customers. In fact, actual trade flows show the opposite trend.

In the first nine months of 2024, for example, the average distance traversed for all traded goods reached a record of 5,000 kilometers as countries increasingly traded with partners beyond their immediate neighbors.

This development is largely due to Europe and the US increasingly trading with Asia, as the continent’s role as ‘the world’s factory’ becomes ever more central to global production networks. This shift has extended the global average distance that goods travel. It also underscores Asia’s continued critical importance as a manufacturing hub, with countries across the continent becoming increasingly integrated into global supply chains.

Intra-Asian trade remains resilient

As the Trade Atlas’ research uncovered, Asia Pacific’s growing role in global trade has been significantly boosted by its ability to adapt with relative agility to supply chain shifts. Many countries in the region have diversified their manufacturing bases, strengthened logistics infrastructure, and embraced digital trade solutions, enhancing resilience and competitiveness.

Trade agreements such as the Regional Comprehensive Economic Partnership also facilitate smoother cross-border trade and investment flows.

“These factors also help boost intra-Asian trade, which remains a crucial driver of regional commerce and a strategic priority for Asia-Pacific businesses,” said Lee.

Vietnam’s trade volume growth is surging

DHL’s Trade Atlas also pinpoints the countries predicted to lead in trade growth over the next five years. It provides a comprehensive picture by examining two dimensions of trade growth: speed (how fast a country’s trade volume is growing) and scale (a country’s absolute increase in trade volume).

In Asia-Pacific, four countries — Vietnam, India, Indonesia, and the Philippines — are forecast to rank among the top 30 for speed and scale.

DHL’s report predicts that Vietnam will maintain a high growth rate of 6.5 percent, driven by its role as an electronics manufacturing hub and alternative production base to China. Along with the United Arab Emirates and Ireland, Vietnam is also the only country ranked among the top 30 for both speed and scale of trade growth over the past five years.

India’s rise as a global powerhouse continues

India claims an essential place in the spotlight. The Atlas predicts that within the next five years, it will be the location of 6 percent of the world’s trade growth, behind only China (12 percent) and the U.S. (10 percent).

As the report highlights, India’s trade growth has been much faster than other large economies. It was only the 13th largest participant in international trade in 2024, but its trade volume grew at a 5.2 percent compound annual rate from 2019 to 2024. Global trade, meanwhile, recorded only 2.0 percent annual growth over this period. The rapid growth in trade volume reflects India’s macroeconomic growth and increasing participation in international trade.

The Atlas reports that in 2023, India ranked second worldwide (after the U.S.) as a destination for announced greenfield foreign direct investments.

Meanwhile, Indonesia and the Philippines have substantial potential to benefit from supply chain shifts and diversification strategies. Indonesia, for example, which has emerged as a favored hub for the metals and chemicals industries, is predicted to rise from 33rd to 25th in the trade volume growth speed rankings. And while the Philippines ranked only 129th on the speed dimension between 2019 and 2024, it is forecast to surge to 15th over the next five years.

Asia Pacific is gaining ground in key industries

Which sectors offer the best opportunities? The Atlas found that electrical machinery and equipment are the second-largest traded product category globally, trailing only manufactured goods. Asia Pacific is set to maintain its leadership in this sector, having commanded a 68 percent share of global exports in 2022.

Indonesia’s metals and chemicals industries are also set for rapid expansion, supported by its rich natural resources and strategic investments. Meanwhile, India is drawing on its strong macroeconomic growth to boost industrial machinery and pharmaceutical exports, solidifying its position as a global manufacturing hub.

Embracing global shifts

As the DHL Trade Atlas 2025 clearly shows, globalization remains resilient despite geopolitical tensions and uncertainties about future trade policies.

“Asia Pacific’s adaptability and accelerating influence in global trade are ensuring the region not only keeps pace but also sets the course for the future of international commerce,” said Lee.

Looking ahead, maintaining collaboration and openness to cross-border trade will be more essential than ever for sustaining the region’s position as a vital player at the heart of the world’s trading networks.

ALSO WORTH READING

English

English